Engineering

Battery Ventures-backed Proemion expands industrial asset analytics platform

The German company has acquired TrendMiner for €47m

Mentha acquires majority stake in Belgian metal-coatings company SPC Group

The portco's founders, Anthony Demaerel and Yves de Mild, and broader management team will remain shareholders

Fund in Focus: Manulife Strategic Secondaries Fund closes on more than €550m

The fund focuses on GP-led secondaries and has already commenced its deployment phase, global head of co-secondaries Jeff Hammer tells Real Deals

ThinCats launches regional fund

The fund targets midsized SMEs across the UK

Equistone-backed Andra Tech Group bolts on Lucassen Group

The GP will support the firm’s expansion in the Netherlands

Genesis Capital acquires minority stake in Kasper Kovo

The firm invested through Genesis Private Equity Fund IV

Exponent backs Ethos Engineering

It is the PE firm’s seventh platform investment in Ireland

Genesis Capital acquires Czech metal manufacturer

GAF has more than doubled its turnover in the last four years

H.I.G. exits ICG Group

The communications business has been sold to a trade buyer

Isatis Capital secures ownership of 3R Industries Group

The firm invests in unlisted French SMEs

Amplio-backed Selatek acquires Deltatec

As of February 2024, Segulah has been rebranded to Amplio

IK Partners invests in Schwingshandl

The Austrian company provides intralogistics automation solutions

Gimv exits Groupe Acceo

The Belgian GP supported the firm with four bolt-ons

Connection Capital backs Winder Power MBO

The GP backed the management with a mix of debt and equity

Deal in Focus: Ambienta acquires Officine Maccaferri

Ambienta’s Mauro Roversi tells Real Deals the GP plans to support the firm via organic and inorganic growth

Altor acquires 90% of Permascand

The deal follows a public cash offer to the portfolio company’s shareholders

Ufenau Capital-backed KSG bolts on Defluo and Maxicleaning

KSG has completed more than 20 bolt-on acquisitions since the GP’s investment in 2017

Triton-backed Renk Group debuts on Frankfurt Stock Exchange

The listing comes after Renk and Triton shelved plans for the planned IPO four months ago

Trilantic Europe acquires solar mounts business

The company’s founder Mathias Muther will remain a significant shareholder

Fondo Italiano D’Investimento FIAF fund holds second close on €225m

EIF, Intesa San Paolo and Eurizon Capital have supported as cornerstone investors

Investindustrial backs Italian engineering company

Fassi Group manufactures lifting equipment and was established in 1965

Deal in Focus: Trimountain Partners invests in the UK’s Horizon Parking Group

Partner Ali Khanbhai tells Real Deals that the GP intends to leverage consolidation opportunities in the fragmented parking services industry

Keensight Capital-backed Sogelink bolts on Geopixel

The bolt-on will help to strengthen Sogelink’s European product offering

Fund in Focus: How Cinven banked $14.5bn for Fund 8

Real Deals catches up with Alexandra Hess, partner and head of investor relations, to discuss how the GP overcame a difficult macro environment to reach the fund’s hard-cap

Accent Equity-backed Malte Månson bolts on Experten Group

Experten’s owners and key management will reinvest in the business

ScaleUp sells edtech business

The acquisition has been completed by a local family office in collaboration with the management team

BGF invests £13m in Metpro

The business also secured financing from NatWest

Segulah-backed Selatek bolts on AllTor Data & Larmteknik

The acquisition consolidates the business’s presence within security services in northern Sweden

Cinven closes flagship fund at $14.5bn

Fund 8 is nearly 30% larger than its predecessor

Foresight backs MBO of industrial company

The MBO has been funded by Foresight’s vehicle dedicated to the Northeast

WestBridge invests in Survey Solutions

The MBO marks WestBridge III’s second deal within five months

Mutares sells Frigoscandia to Dachser

With the transaction, Mutares completes its eighth exit in 2023

MML Ireland invests in Mainport Shipping

The GP is investing alongside Irish Mainport Holdings as a “significant” minority shareholder

Axcel-backed XPartners completes three bolt-ons

The deal will strengthen XPartners’ commitment to sustainability

Patrimonium acquires majority stake in TestSolutions

The GP is aiming to strengthen the firm’s presence in the DACH market

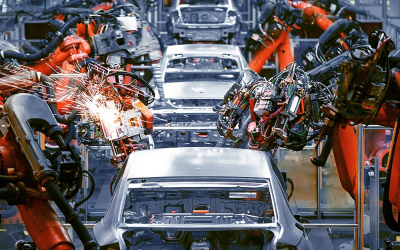

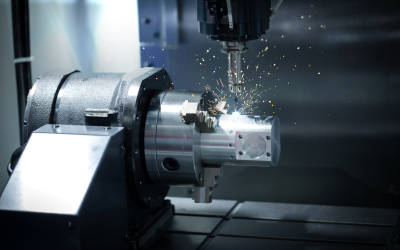

Industrials Report: Deals flow despite headwinds – Reals Deals Data Hub

Despite an increasing emphasis on technology and digitalisation among investors, the industrial heartland of Europe still offers good opportunities for investors. Julian Longhurst reports

Real Deals Industrials Report 2023

As the industrials sector undergoes transformative change, private equity firms are targeting businesses and subsectors where they can add the right elements to create value

One Equity Partners carves out metering solutions business

TechipFMS Measurement Solutions employs 450 people and has facilities in Germany and the US

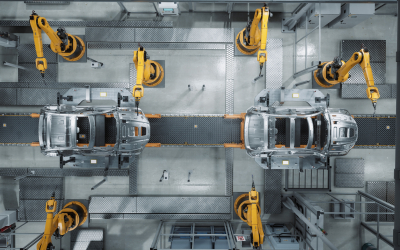

Mutares-backed automobile group adds on High Precision Components

The turnaround investor acquired KICO in 2019 and merged it with Innomotive Systems Hainichen in 2021

Deal in Focus: Mindful Capital’s fourth fund completes debut investment

Managing partner Alberto Camaggi tells Real Deals that he expects the fund’s next close from December at the earliest

Helix Kapital-backed L5 Navigation bolts on GeoFix

The management of GeoFix will continue to lead the business

Arcano Partners launches aviation assets vehicle

Arcano Aviation Fund PEF aims to raise €100m

Oakley Capital expands Iberian footprint with Alerce acquisition

The GP has also made other investments in the Spanish region, including vLex, Idealista and Seedtag

Mindful Capital’s fourth fund completes debut investment

The GP has acquired a majority stake in Fiorini Industries

Bolster sells stake in Movares to Convent Capital-backed Innovus

The seller was a shareholder in the business for 17 years

Genesis Capital backs audiovisual and event business

The firm invested in AV Media Group through its Fund IV

Renatus marks first deal from new €60m fund

The GP has acquired a majority stake in W.H. Scott Group

Mutares acquires building component manufacturer

This is the GP’s eighth acquisition including bolt-ons in 2023

Segulah partially exits oil and gas services company via IPO

The GP acquired an 83% stake in the company in 2013 through its fourth fund

Axcel forms new platform company with Tic Elkas and Eegholm Group acquisitions

The deal marks the third investment from Axcel Fund VII

Gimv to sell Groupe Claire to Crédit Mutuel Equity

Gimv invests in small to medium-sized companies in Benelux, France or the DACH countries with capital needs of €5-75m

Hayfin exits Autovista Group after 8 year hold

Buyer J.D. Power expands its automotive data and analytics portfolio in Europe and Australia with the acquisition

Gimv’s Techinfra adds on Keil & Purkl

The deal marks the portfolio company’s second bolt-on

Baird Capital’s CAV exit goes airborne

The GP first invested in the portfolio company in 2017

EV Private Equity conducts Trainor trade sale

The Norwegian GP originally invested in the portfolio company in 2020 through its Energy Transition Fund I

Summit Partners invests in Certania

The growth investment is earmarked for the testing, inspection and certification company’s acquisitive growth strategy

ECM sells PikeTec

The Berlin software provider has been acquired by US company Synopsys

ECM Equity Capital Management backs SIS and ENDEGS merger to form ETS Group

ECM’s German Equity Partners V fund had already acquired a majority stake in the business in 2019

KKR partially exits A-Gas to TPG

KKR acquired the business through an SBO with LDC in 2017

KKR takes minority stake in delisting OHB

The Fuchs family will remain the majority shareholder of the company

Aksìa engineers Kintek Group acquisition

Transaction marks the tenth investment from the Italian GP’s Aksìa Capital V fund

Deal in Focus: New firm Px3 Partners pens second carve-out deal

Px3’s co-founders shared the investment plans for Cofimco with Real Deals

Adelis-backed Presto completes 36th bolt-on

The acquisition of Jockel marks its expansion into the German market

Mutares’ Ferral United bolts on Selzer Group

The GP first invested in Ferral United in 2020, acquiring the business from Tekfor Group, TCH and Magna

Inflexion to exit Xtrac to US investor

Inflexion defies market gloom by notching up its fifth exit this year

WestBridge’s APEM completes fifth add-on

WestBridge first backed the management buyout of the environmental consultancy firm in March 2019

Inflexion closes Buyout Fund 2010 vintage achieving 25% IRR

The GP sold PD&MS Group to RSK Group in a trade sale

Levine Leichtman exits SK AeroSafety stake to Bridgepoint

The GP first invested in the company in 2019 and has expanded its geographic footprint

Triton’s OCU Group acquires Hornbill Group

Triton acquired OCU in August 2022 through its Triton Fund V

Seven2 acquires majority stake in Infraneo from Sparring Capital

The GP said it plans to grow Infraneo through digital transformation and an “ambitious” build-up strategy

EQT sells BBS Automation for €440m+

During EQT's five-year holding period, the company has “more than doubled” its revenues.

Inflexion’s BES Group acquires Engineering Safety Inspection Services

Following the announcement, BES said it plans new acquisitions this year and beyond, with a focus on companies that complement and enhance its risk management solutions.

Freshstream to back MCR Group

The deal is the fifth investment from Freshstream Investment Partners' debut independent fund, which closed on €762m this month.

BaltCap to take 70% of Hansab

Following the deal’s completion, Janno Kallikorm, CEO of AS Hansab Estonia, will replace founder Aigar Urva as the new CEO of Hansab Group.

Beech Tree picks up minority stake in Leicestershire’s Obsequio Group

The firm has invested out of its most recent fund, supported by acquisition debt from Beechbrook Capital.

N4 Partners exits David Brown Santasalo to Stellex Capital Management

N4 Partners supported the merger between David Brown and Santasalo in 2016, transforming the business's focus in engineering and defence.

Deal in Focus: Equistone caps off Bulgin carve-out with trade sale to US buyer

Following the late-January sale to Infinite Electronics, Jennifer Forrest looks back on the value-creation playbook with Equistone's Paul Harper and Tristan Manuel.

Aliter completes secondary investment in Edwin James Group

The firm completed the fund-to-fund transaction through its sophomore fund, Aliter Capital II, after first investing in the group in 2017 through its maiden fund, Aliter Capital I.

Deal in Focus: ARX toasts successful TES Vsetin turnaround

Following completion of the deal, Jennifer Forrest looks back on the successful restructuring of the asset and the investment rationale for its new backers.

MML and BPI France co-invest in Kickmaker

The deal represents the second from MML’s lower mid-cap strategy, Enterprise, which invests £10-25m in B2B companies with up to £6m Ebitda.

Tikehau-backed EuroGroup lists in €922m IPO

The IPO comes more than two years after the company received investment from Tikehau Capital, which secured a 30% stake in September 2020.

FSN Capital forms Danish energy-efficiency installation business

FSN Capital VI has created InstallatørGruppen via the merger of 11 technical installation companies.

CVC and Nordic Capital-backed Cary Group to acquire Gotlands Plåt & Billack

CVC Capital Partners and Nordic Capital completed the joint take-private of Cary Group in October 2022 via Nordic Capital’s Fund XI and CVC’s Fund VIII.

HIG Capital on the up with Classic Lifts deal

The acquisition follows HIG’s acquisition of CPS, a UK mechanical and electrical building services provider, as the PE firm seeks to build a broader technical building services group.

Gimv backs Rohrleitungsbau Münster

The investment will become part of Gimv’s Sustainable Cities platform.

Duke Street acquires Suir from EDF Energy Services

Suir Engineering was acquired in 2017 by EDF Energy Services, a joint venture between the French energy group EDF and Dalkia, an energy services and facilities management subsidiary.

Siparex invests in F2A Group through France Nuclear Fund

The investment, backed by Garibaldi Participations and BNP Paribas Développement, is the fourth from the France Nuclear Fund.

Keensight Capital’s Symeres adds on Exemplify

Keensight Capital-backed Symeres has acquired Exemplify BioPharma. Keensight Capital acquired Symeres from Gilde Healthcare Private Equity in 2021.

Buckthorn Partners to acquire Amey Group

Buckthorn is to partner with One Equity Partners, with the value creation focusing on the energy transition.

Chequers Capital acquires Somacis Graphic from Green Arrow Capital

Italy-headquartered Green Arrow Capital, which has €2bn in assets under management, first invested in Somacis in 2016.

Rivean Capital sells Muon Group to trade

The transaction sees Muon Group acquired by NYSE-listed Idex Corporation for an enterprise value of €700m.

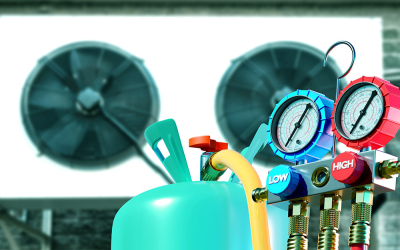

Segulah-backed Francks Kylindustri acquires Sogn Kjøleservice

The add-on acquisition will support the business as it expands in Western Norway.

Primary Capital refinances Metamark

Primary Capital has refinanced and recapitalised Metamark, a manufacturer and supplier of self-adhesive visual communication materials.

Genesis Capital and Integral Venture Partners back BORCAD

Central European growth investor Genesis Capital and growth fund Integral Venture Partners have acquired 100 per cent of BORCAD, a producer of train seats and interior equipment.

Palatine’s CTS Group completes ninth acquisition

Palatine-backed CTS Group has acquired geo-technical and geo-environmental specialist In Situ Site Investigation Limited.

Rcapital acquires Trac Precision Machining

The investment is the latest in a number of deals Rcapital has completed in the engineering sector.

Triton acquires Kälte Eckert

Triton has acquired a majority stake in the refrigeration business via Triton Smaller Mid-Cap Fund II, marking its eighth platform acquisition.

Tikehau Ace Capital doubles down on Tecalemit

Tikehau Ace Capital is supporting its existing portfolio company in a new recapitalisation operation.

Tikehau Ace Capital acquires Visco

Tikehau Ace Capital has bought the French high-precision mechanical machining business Visco.

Segulah-backed Levinsgruppen bolts on AF Elteknik

The add-on acquisition further strengthens the business' position in Stockholm and Mälardalen.