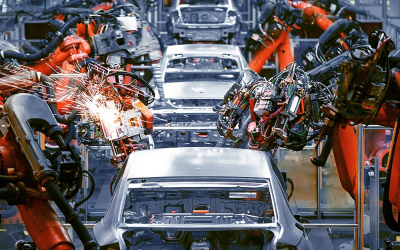

Manufacturing

Nexxus Iberia marks debut investment from second fund

The Spanish GP has acquired a majority stake in retail equipment manufacturer Creaciones Marsanz

IK Partners invests in A-Safe

The Yorkshire-based company produces polymer-based products for factories and warehouses

Battery Ventures-backed Proemion expands industrial asset analytics platform

The German company has acquired TrendMiner for €47m

FairCap carves out Swedish agricultural manufacturer

Transaction was "complex", involving several offices, according to FairCap

FCDE acquires French textile-fibre designer

Kermel’s management team, led by CEO Philippe Declerck, has also invested in the firm

Cairngorm Capital sells industrial specialist distributor

During the GP's holding period the business completed one acquisition

Fund in Focus: Manulife Strategic Secondaries Fund closes on more than €550m

The fund focuses on GP-led secondaries and has already commenced its deployment phase, global head of co-secondaries Jeff Hammer tells Real Deals

MVI Equity-backed Nordic Drives Group bolsters Danish portfolio with new acquisition

The deal further strengthens the business's capabilities in Northern Europe

One Equity Partners acquires CBM

The GP seeks to support the internationalisation of the business

Stellum Capital and Inveready acquire minority stake in LEV 2050

It is the seventh investment from the Stellum Food&Tech I fund, while Inveready invested from its Inveready Biotech IV vehicle

ThinCats launches regional fund

The fund targets midsized SMEs across the UK

Equistone-backed Andra Tech Group bolts on Lucassen Group

The GP will support the firm’s expansion in the Netherlands

Quantum Capital Partners exits aluminium producer in trade sale

The Munich-based firm acquired the company in 2014

Sherpa sells Horizons Optical

Sherpa acquired the business in 2017 through its Fund II

H.I.G. carves out Valeo’s thermal commercial vehicles division

The portfolio company will operate under the name Spheros

EQT sells stake in Ottobock

The transaction is set to value the prosthetics firm at €5.5bn

Unigrains Italia acquires La Prensa

The GP aims to support the business’s development through organic and external growth

Mutares carves out Iveco Group’s Magirus

The GP plans to expand the firm’s market share both domestically and overseas

Talde Private Equity acquires Plymouth Group

The deal represents the fourth investment of Talde Capital Crecimiento II FCR fund

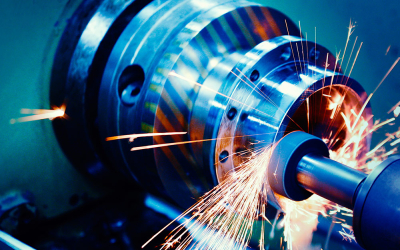

Genesis Capital acquires Czech metal manufacturer

GAF has more than doubled its turnover in the last four years

FSN Capital-backed OptiGroup bolts on Ubro SystemPac A/S

The GP aims to consolidate the business’s presence in the Nordics

Liberta Partners acquires AMEC

The deal represents the first acquisition from Fund III, which closed on €75m

Palatine’s maiden Growth Credit Fund holds first close

The fund will support maturing, high-growth but not startup companies

B & Capital exits Steliau to Astorg

The deal marks the buyer’s fifth investment from its Astorg VIII fund

GP Profile: Arca Space Capital

CEO Ugo Loeser tells Real Deals the PE fund is currently assessing two new deals

Chiltern backs MBO of Strata Products

The GP will support the firm’s product offering and expansion

GP Profile: Perwyn

Managing partner Andrew Wynn speaks to Real Deals about what makes the perfect deal and the firm's new office in Milan

Auctus exits Profiltubi Group

The GP first invested a majority stake in the business in 2020

Bregal-backed Italgel Group bolts on Protein

It is the first acquisition by Italgel since Bregal first invested in 2022

Ufenau Capital-backed KSG bolts on Defluo and Maxicleaning

KSG has completed more than 20 bolt-on acquisitions since the GP’s investment in 2017

Fund in Focus: Fondo Italiano d’Investimento’s co-investment fund hits first close on €82m

Roberto Travaglino tells Real Deals that the investor hopes to reach its final close within 12 months

Triton-backed Renk Group debuts on Frankfurt Stock Exchange

The listing comes after Renk and Triton shelved plans for the planned IPO four months ago

Accent Equity sells Norco Interior to its own portco

The GP’s Götessons Design Group has bolted on the business

AIB Foresight SME Impact Fund holds second closing

The fund received a cornerstone commitment from AIB in 2022

Fondo Italiano D’Investimento FIAF fund holds second close on €225m

EIF, Intesa San Paolo and Eurizon Capital have supported as cornerstone investors

Rockpool’s EC Electronics bolts on Liad Electronics

It is the portco’s second bolt-on following the GP's investment in September 2022

Accent Equity acquires majority stake in Plockmatic Group from Grimaldi Industri

Plockmatic’s management team will also invest in the business

Investindustrial backs Italian engineering company

Fassi Group manufactures lifting equipment and was established in 1965

BGF invests £13m in Metpro

The business also secured financing from NatWest

Yotta Capital and Sofiouest exit semiconductor materials firm

Recif Technologies has been part of Yotta’s and Sofiouest’s portfolios since 2021

Mutares sells Valti to management

The GP exited after only holding the firm since June 2022

BGF invests in outdoor furniture firm

The growth investor will support Akula Partners’ international expansion

Deal in Focus: GED Capital sells Procubitos Europe to Magnum

The blend of organic and inorganic growth saw the firm quadruple its revenues, Enrique Centelles Satrústegui, GED Capital tells Real Deals

PAI Partners exits diagnostics manufacturer

ELITech was sold to Bunker Corporations

Egeria exits sustainable packaging solutions firm

Wentus has been sold in a trade deal to Trioworld Group

Deal in Focus: Lionrock acquires Haglöfs from Asics

The firm’s European head Tom Pitts tells Real Deals the brand has been in the GP’s sights for years

Fund in Focus: Foresight seeks SME opps for two new funds

The GP remains sector agnostic and has ticket sizes of up to £10m, partner Matt Smith tells Real Deals

Unigrains acquires stake in Elan

The acquisition will bolster the business's presence within Central and Eastern Asia

Deutsche Invest carves out Leoni AG’s wire products vertical

The firm’s special situations strategy backs companies with sales of €40-750m

Ara Partners closes third vintage on $2.8bn

The oversubscribed private equity fund closed on its hard-cap

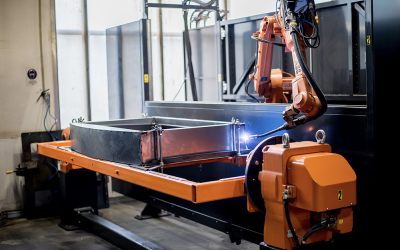

Industrials Report: Powering ahead

Mark Howden and Will Scales, investment directors at LDC, discuss how industrials businesses are taking advantage of opportunities for growth while navigating challenges, including supply chain risk and skills shortages

Industrials Report: A sector in a state of flux

The industrials sector faces a myriad of challenges from supply chain disruption to sustainability pressures. Taku Dzimwasha explores whether the sector remains attractive to PE investors

Abris offloads hygiene product manufacturer to Partners Group

The business was acquired in 2018 from Polish private equity fund Avallon

Industrials Report: Deals flow despite headwinds – Reals Deals Data Hub

Despite an increasing emphasis on technology and digitalisation among investors, the industrial heartland of Europe still offers good opportunities for investors. Julian Longhurst reports

Siparex-led consortium exits Nowak industrial group

The company’s turnover has increased by 76% in five years

Gimv and Paragon exit Wemas in trade sale

The company has strengthened its position in traffic safety technology

Equistone-backed Andra Tech Group bolts on Lemmens Metaalbewerking

The deal will strengthen the firm’s position in DACH markets

FSN Capital-backed OptiGroup bolts on protective equipment firm

FSN Capital Partners acquired the business in 2021

SK Capital-backed Ecopol bolts on JRF Technology

Following the deal, president James Rossman will continue at the helm

Pinova Capital-backed Detax acquires Thermotec

The business was acquired from Heba

Genesis Capital exits majority stake in Sanborn

During the GP’s hold period, the firm doubled its turnover and Ebitda

Real Deals Industrials Report 2023

As the industrials sector undergoes transformative change, private equity firms are targeting businesses and subsectors where they can add the right elements to create value

How Bregal achieved dragon status with €1.59bn EA exit

Real Deals catches up with BU’s co-founder and managing partner Florian Schick to learn about last month’s mammoth deal

Innova-backed Bielenda acquires Torf from Resource Partners

The bolt-on will also enable the company to enter the oral hygiene segment

INVL wholly acquires Galinta Group

The deal is the ninth portfolio investment for its INVL Baltic Sea Growth Fund

Jet Investment acquires 70% of Likov

It marks the first completed transaction from the investor’s Jet 3 fund

NorthEdge invests in Torbay Pharmaceuticals

This is the GP’s seventh healthcare investment

Gilde Healthcare picks up surgical instruments manufacturer

The GP will merge Koscher & Würtz with a portfolio company

Genesis Capital acquires STT Servis

The GP will support the firm’s expansion and client roster

UI Investissement exits stake in Iagona

The sale will see Iagona restructure its shareholding around its management

Wise Equity-backed Special Flanges acquires Hertecant Flanges

The Italian GP first backed the portfolio company in October 2021

Cerea Partners-backed Axium acquires Italian packaging company

The bolt-on of Silte will allow Axium to strengthen its geographical coverage

Foresight nets 3.2x return on ONFAB stake sale

This is the seventh exit from Foresight’s Regional Investment Fund

Mutares exits Plati Elettroforniture to Accursia Capital

The sale represents the GP’s seventh exit in 2023

Mutares-backed automobile group adds on High Precision Components

The turnaround investor acquired KICO in 2019 and merged it with Innomotive Systems Hainichen in 2021

Oakley Capital expands Iberian footprint with Alerce acquisition

The GP has also made other investments in the Spanish region, including vLex, Idealista and Seedtag

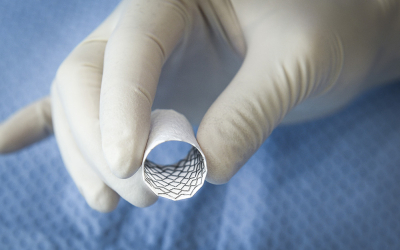

Keensight Capital co-invests in stent manufacturer

AP Moller Holding and Bonit Capital have also invested in Bentley Endovascular Group

Motion Equity-backed portco carves out plastic packaging vertical

The GP acquired a majority stake in the company in September 2022

Progressio exits Garda Plast Group stake

During the seller’s stint as a shareholder, GP Group generated revenues of more than €90m in 2022

Waterland portco completes triple acquisition

Carton Group also completed a refinance of its debt

Bregal sells EA Elektro-Automatik in €1.58bn deal

The GP acquired the portfolio company from its founders in 2019 through its second fund

OEP exits Walki in trade sale

The midmarket PE firm acquired Walki in July 2018

BNP Paribas Développement acquires Le Guellec

The GP plans to strengthen the firm’s global presence

Rivean Capital exits ELCEE

Torqx Capital Partners has acquired a majority stake in the business

BGF acquires multimillion-pound stake in Artus Air

The GP plans to strengthen the firm’s technical expertise and innovative touch towards the acceleration of net-zero targets

Segulah partially exits oil and gas services company via IPO

The GP acquired an 83% stake in the company in 2013 through its fourth fund

EQT sells LimaCorporate to Enovis Corporation

The GP acquired LimaCorporate from Ardian in 2016, via its EQT VII fund

IK Partners acquires controlling stake in MMS from Naxicap Partners

IK will support the company to consolidate in the IoT, metrology and validation services spaces

Wise Equity exits Aleph in trade sale

The sale represents the GP’s fifth divestment from Wisequity IV

Anchorage and CVC Credit exit Ideal Standard to Villeroy & Boch

The acquisition price is based on a company valuation of approximately €600m

Hayfin exits Autovista Group after 8 year hold

Buyer J.D. Power expands its automotive data and analytics portfolio in Europe and Australia with the acquisition

UI Investissement backs The Physitek Group

Andera Acto had been supporting the company since January 2021

Baird Capital’s CAV exit goes airborne

The GP first invested in the portfolio company in 2017

GED Capital-backed ENSO boxes clever with Vertical Bag acquisition

The bolt-on allows ENSO to enter new markets and position itself as a global packaging group

Quantum Capital carves out Flensburg from MPE

The Flensburg mill acquisition is the third paper industry investment by the GP

Qualitas does double co-investment

The Spanish fund-of-funds has invested in FCDE’s Lindera and Vendis’s Meubelzorg

Summit Partners invests in Certania

The growth investment is earmarked for the testing, inspection and certification company’s acquisitive growth strategy

Exponent partially divests Meadow

Canadian holding company Fairfax Financial has picked up a portion of the GP’s stake in the speciality ingredients company

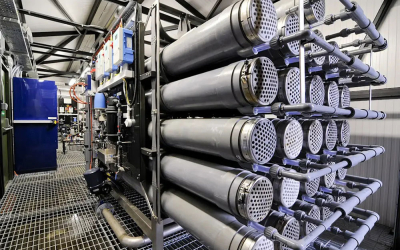

Exclusive: MML picks up minority stake in water treatment provider RSE

The GP says the water sector is in need of innovation to drive better social and environmental outcomes

Enterprise Investors picks up minority stake in Advanced Protection Systems

The GP said the portfolio company is poised to execute an international expansion strategy