Insights

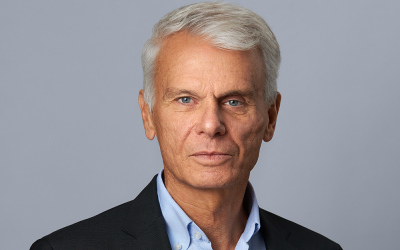

Hidden gems

Dunport Capital’s Ross Morrow examines the lower midmarket – an overlooked and underappreciated segment of the private credit market

Staying competitive

MUFG’s David Rochford explains why Ireland is taking a greater role as an operational centre in the alternatives industry

Alternative asset classes set to see biggest increase in fundraising in 2024

Some 71% of wealth managers and institutional investors surveyed by Carne Group expect to increase their allocation to private equity by 10% or more this year

Europe’s refinancing wave

GPs struggled to refinance portco debt in last year’s choppy markets. But with interest rates expected to come down, fortunes could be improving, as Xhulio Ismalaj reports

Vulture: Getting your priorities right, and when internal emails go external…

The Old Bird is back with a couple more juicy morsels

Roundtable: Lending in times of volatility

In this discussion, we discover how lenders have kept deploying capital and supporting private equity firms in the face of stiffening market headwinds

Venture Views: Two Magnolias on a mission to embrace diversity every step of the way

Real Deals' Shivani Khandekar catches up with co-founders Jessica Rasmussen and Marie Korde to understand the importance of diversity in venture capital and what makes their firm stand out

Debt set: part one – Bomb squad

Taku Dzimwasha investigates if private credit can sustain its allure amid rising concerns

Climatetech’s second wind

Climatetech has emerged as a pivotal sustainability investment theme for private equity. Xhulio Ismalaj explores the journey climatetech businesses have been through in the midmarket and finds out why the future for the subsector remains hopeful

Making an impact

Sustainability and ESG factors have become a priority for GPs across the investment cycle. But does it pay to be sustainable? Silvia Iacovcich reports

Expect fundraising to slow following ‘record’ quarter: PitchBook

European funds have already amassed more than half the capital raised in 2023, according to PitchBook’s Q1 2024 Global Private Equity First Look report

Real Deals Sustainability Report 2024

In this special report, we explore how GPs are utilising sustainability as a value creation lever

Comment: Technology’s sustainability challenge

It is time to embrace the opportunities that come with the technology industry’s shortcomings, according to Bettina Denis, head of sustainability at Revaia

Gaining territory

Ireland’s ILPA set out to enhance the country’s appeal as a fund jurisdiction in 2020 but progress has been sluggish due to investors’ preference for Luxembourg. However, the Emerald Isle is now upping its game, as Shivani Khandekar discovers

Continuation funds shine as sponsors crave liquidity – Houlihan Lokey

The trend comes as sponsors deploy creative strategies to optimise portfolios and create liquidity

Comment: PE taps into flourishing wealth management sector

With an ageing population and burgeoning market, Houlihan Lokey’s Christian Kent discusses the rise of private equity interest in the wealth management sector

Technology Report 2024

Welcome to the first instalment of the Technology Report, which shines a light on GPs at the cutting edge of tech adoption for front-office functions, and the providers powering that transformation

ESG considerations are here to stay

Dasseti’s Billy Cotter and Evan Crowley discuss the most talked-about acronym in the private equity industry

Transforming portfolio monitoring and ops with tech

Establishing a centralised point of contact and a single source of truth is critical for portfolio monitoring and reporting, says Pratap Narayan Singh, senior director and head of private markets at Acuity Knowledge Partners

The power of cyber risk intelligence in private equity

Proactive cyber risk management is essential to preserving value across the investment lifecycle, says KYND chief executive and founder Andy Thomas

Evolving retail trends

Technology has an integral role to play as private markets adapt to the needs and expectations of retail investors and HNWIs, according to Yann Magnan, CEO and co-founder of 73 Strings, and Jonathan Balkin, co-founder and executive director of Lionpoint

Navigating AI in private equity

Frister Haveman from Gain.pro discusses the role GenAI has in the private equity market and why it should be embraced, not feared

Case study: A customised approach

Kim Carter from LKCM Headwater and Passthrough’s Ben Doran explain how collaboration is key for a successful partnership

Entering a transformative era

AI-based deal-sourcing tools can automate market mapping and company research, giving firms the time they need for higher-value activities. Ruth Eagle is head of origination at CBPE, a client of deal-sourcing platform Sourcescrub

Q&A: The digital edge

Yair Erez and David Poole, partners at Stanley Capital, discuss how the firm is using a combination of proprietary and third-party technology to accelerate target identification and expedite deal conversion

Q&A: A model idea

A bespoke solution was key for ECI’s deal origination process according to Suzanne Pike, partner and head of origination at the firm

Q&A: Building a tech Nexus

NorthEdge’s Lucie Mills and James Hales discuss how the mid-cap GP is using technology to support deal origination, identify potential deal targets and enrich various interactions

Q&A: A journey of discovery

Philippe Laval, chief technology officer at Jolt Capital, discusses its proprietary software platform Ninja, and reflects on the highs and lows of bringing the system to life

Q&A: Transforming with tech

David Floyd, vice-president at global investment firm Permira, talks to Real Deals about how the business is harnessing advanced analytics and AI to drive competitive advantage internally and in its funds’ portfolio companies

Going digital

Nicholas Neveling explores how GPs are harnessing big data and AI not only to boost portfolio company performance, but also to provide a competitive edge when it comes to sourcing and executing deals

The Private Equity Value Report 2024

Charting the fastest-growing private equity-backed companies in the UK, in association with BDO

Webinar: From confusion to clarity

Experts explain how GPs can support portcos in doing their CSRD double materiality assessment right

In conversation: Kerry Baldwin, IQ Capital

The VC co-founder shares useful tips for women thinking of entering the venture capital industry

Vulture: Dealcraft meets Minecraft, and The Name Game

The Old Bird's game for a laugh...

Guardians of capital

In February, Real Deals hosted a cybersecurity webinar in collaboration with Doherty Associates. During the discussion, experts in the space discussed the cyber threat, ways to mitigate it and how to respond when an incident occurs

Private equity’s exit logjam hits $3.2trn

GPs are sitting on a record 28,000 unsold companies, According to Bain & Co’s annual global PE report

The hunt for CFOs for PE-backed firms has become more volatile – Finatal

Managing director Jack Lane reveals the strategies PE firms are employing to tackle the CFO talent crunch

Exclusive: Tresmares to close third PE fund in March

The Spanish firm also plans to open new offices and launch additional funds, partner Ignacio Calderón tells Real Deals

GPs ride the data wave

Demanding LPs and AI advancements have moved the dial on data. But what does a data strategy during a holding period look like? Xhulio Ismalaj reports

IWD: Helen Steers, Pantheon Ventures

To celebrate International Women’s Day, Real Deals catches up with Pantheon partner Helen Steers to discuss what it means to be a woman in private equity

In conversation: Future Business Partnership’s founders discuss achieving B Corp status

Real Deals sits down with founders Tracey Huggett and Vish Srivastava to understand the motivation for the certification and how it will impact its talent and investment strategy

Webinar: Guardians of capital

This discussion explores how PE firms can protect their portcos from cyber threats

Exclusive: Quilvest acquires Acuiti Labs

Thomas Vatier, partner and co-head of buyout, tells Real Deals that the investor plans on leveraging its transatlantic expertise to grow the business

Podcast: What do LPs want?

British Patient Capital’s Christine Hockley discusses the importance of patient capital, what VCs must do to appeal to LPs, and how GPs can build a value proposition that aligns with their investors’ interests

LP View: LPs seek ‘GP 2.0’ in challenging environment

In an environment where LPs have been wrestling with the denominator effect, reshuffling their portfolio allocations and contemplating new strategies for liquidity, Silvia Iacovcich explores what institutional investors are expecting from ‘GP 2.0’

SFDR: Bridging the gap

The EC's SFDR consultation has increased the pressure on GPs and LPs to navigate the multitude of demands within their relationships. Silvia Iacovcich explores how the framework can be improved

Podcast: The struggles of ESG reporting

In this exclusive podcast, Real Deals reporter Xhulio Ismalaj is joined by Richard Burrett, chief sustainability officer at early-stage cleantech investor Earth Capital

Changing lanes: continuation vehicles steering a new course in investment strategies

Industry experts are bullish on continuation vehicles as a viable exit route. But issues around pricing, fees and carry loom large. Real Deals speaks to secondary players to understand how these can be navigated to minimise conflicts of interest

GP Profile: Arca Space Capital

CEO Ugo Loeser tells Real Deals the PE fund is currently assessing two new deals

Venture Views: Zebra Impact eyes smorgasbord of agrifood investment opportunities

Real Deals' Shivani Khandekar sits down with co-founder Fabio Sofia to understand the impact investor’s thesis and fundraising plans

GP Profile: Perwyn

Managing partner Andrew Wynn speaks to Real Deals about what makes the perfect deal and the firm's new office in Milan

Venture Views: Target Global co-founder discusses an up-and-down year

Real Deals sits down with Yaron Valler to get his perspective on down rounds, the firm’s Israeli investments and the outlook for VC in 2024

Deal originators part one: The art of the deal

Deal origination has come into its own as the macro environment has become challenging, prompting GPs to seek innovative strategies for deal sourcing and execution. Silvia Iacovcich examines how the originators have adapted to the new normal

Deal in Focus: Investindustrial forms Sammontana Group with €1bn revenue

The GP's founder Andrea Bonomi tells Real Deals that the GP is already looking at three US-based bolt-ons to expand the firm’s offering

Video: Unravelling ESG

What better time to unpick key ESG trends than at the Real Deals ESG Conference 2024? Silvia Saccardi speaks to Investindustrial’s Dr Serge Younes, IP Group’s Bran Pathmanāban and Ambienta’s Fabio Ranghino

ESG Conference 2024: The biodiversity challenge

A panel on assessing biodiversity impacts explored how the emerging push for biodiversity risk mitigation is influencing investment decision-making. Xhulio Ismalaj reports on one of the key issues discussed

ESG Conference 2024: Leveraging the value chain

In the final panel on day one, industry experts explored how the value chain can drive transformational change. Silvia Iacovcich reports

ESG Conference 2024: PE’s ESG evolution

Real Deals held its ESG Conference on 30-31 January. On day one, industry experts explored how ESG has evolved to become a key part of GPs’ strategies. Shivani Khandekar reports

PE firms struggle with ESG reporting balancing act

With unending developments in ESG reporting, Xhulio Ismalaj asks: just how much transparency is midmarket PE able to live with? And is it all in vain?

Flat final quarter caps off relatively solid year – Real Deals Data Hub

Deal activity in 2023 started slow but remained steady throughout the year despite challenges, especially for larger cap brackets, with impressive overall deal volumes. Julian Longhurst investigates the numbers

CEE Report 2024: Forging a partnership

Max Cancre, director at TA Associates, and Filip Berkowski, investment partner at MCI Capital, speak to Real Deals about how their collaboration has yielded success

CEE Report 2024: Building champions

Real Deals speaks to MidEuropa’s operating partner Alain Beyens about how the Central Europe private equity firm taps into its local expertise to create international success

CEE Report 2024: Getting down to work

Pawel Gierynski and Stephen Richmond of Abris Capital Partners talk to Real Deals about capitalising on opportunity in Central Europe with market knowledge, technology and ESG

Expert View: Are minority investments gaining ground on majority deals?

Debevoise & Plimpton partners E Raman Bet-Mansour and Dominic Blaxill, and Jake Grandison, associate, explore whether minority investments are set to become the new majority and what GPs need to consider before undertaking such deals

TMT Report 2024: Wired for investment

Chris Baker, Aylesh Patel and Oliver Schofield, investors at leading UK midmarket private equity firm LDC, on why TMT businesses remain an attractive opportunity for private equity and the key trends driving M&A in the sector

CEE: Road to recovery

Deal activity in CEE reignited in 2023 as the instability from the previous years started to dissipate. But will the recovery continue this year? Shivani Khandekar investigates

TMT Report 2024: Leading lights

Real Deals speaks to James Searby of Directorbank about how finding the right talent can boost the growth of technology businesses

Organic Growth: Foresight and Partners Group reveal their tech playbooks

In this Organic Growth special, we speak to Foresight and Partners Group about how the GPs’ value creation strategies led to their successful exits of Fresh Relevance and Civica respectively

TMT Report 2024: Turn the page

Amid increasing interest from tech investors in B2B information services, Xhulio Ismalaj explores the subsector

Q&A: Reimagining infrastructure

Real Deals catches up with MML Infrastructure’s co-managing partners Andrew Honan and Sharand Maharaj to discuss how private equity expertise supports the GP’s infrastructure strategy

TMT Report 2024: PE investors go back to basics

Within TMT, tech tailwinds continue to attract PE to the space despite a valuation correction. GPs are now focused on revenue-generating businesses more than ever. Taku Dzimwasha investigates

Comment: The craft of commercial due diligence

James Tetherton, senior partner at GRAPH Strategy, explains how CDD can make the difference in an increasingly complex deal landscape

TMT Report 2024: Dealflow slows but large transactions boost overall transaction value

Since the beginning of 2021, the level of sponsor-backed M&A activity in the European TMT space has fallen noticeably, though a handful of giant deals continue to grab the headlines. Julian Longhurst looks at figures from Dealogic

Real Deals TMT Report 2024

Exploring the transformative trends and compelling stories shaping private equity in the TMT sector

Q&A: Tapping into revenue

Jennifer Murray and James Salmon, Shawbrook, discuss the bank’s new recurring revenue loan offering

Comment: Which UK sectors are most exposed to headwinds?

Alex Cadwallader, director – head of south and offshore, Leonard Curtis, considers the headwinds facing key UK sectors in 2024

Comment: Is the UK midmarket on the rise?

LDC’s John Garner outlines why increased demand for funding from ambitious medium-sized companies will drive a resurgent UK M&A market in the year ahead

The best of 2023

Real Deals looks back at the key talking points from 2023, a year when the private equity industry faced a difficult dealmaking and fundraising environment

Industry leaders give their predictions for 2024

Real Deals speaks to industry leaders to get their insights and discover their predictions for 2024. From high interest rates to valuation mismatches, these experts outline how the private equity industry can navigate a challenging environment

Humatica Corner: Don’t fall into the distributed services trap

Investing in distributed service firms is in vogue. But ensuring the investment provides returns is not straightforward

Vulture: Eat, pay, free press | From lineouts to layouts

No such thing as a free lunch?

The midmarket engine continues to purr – Real Deals Data Hub

Despite tricky investment conditions, activity in the European midmarket space continues to grow, albeit modestly, with the France/Benelux region leading the way. Julian Longhurst reports

GPs anticipate deal valuations will decline in 2024 – Investec

The firm’s report reveals that the market will remain challenging this year but pockets of opportunities exist

Venture Views: ETF Partners’ Patrick Sheehan discusses how sustainable investment can beat the downturn

The co-founder and managing partner also shares his mantra for being active during a dip

Fund in Focus: How Cinven banked $14.5bn for Fund 8

Real Deals catches up with Alexandra Hess, partner and head of investor relations, to discuss how the GP overcame a difficult macro environment to reach the fund’s hard-cap

Roundtable: Special situation market players find special purpose

With UK corporate insolvencies high, the special situations community looks to step up to the plate. But will 2024 be the year of the turnaround?

End of Year Review: HarbourVest Partners

David Atterbury, Craig MacDonald and Alex Wolf, managing directors at HarbourVest Partners, speak to Real Deals about secondaries, carve-outs and much more

GP Profile: Swen Capital Partners

Co-founder and CEO Jerome Delmas talks to Real Deals about the importance of expertise in impact investing

Investors to boost acquisitions in 2024

Ocorian’s 2024 outlook reveals that investors are increasing their risk appetite

End of Year Review: Malcolm Coffin, Inflexion

Real Deals catches up with Malcolm Coffin, partner, Inflexion, to discuss his outlook for 2024

Fundraising trends to look out for in 2024

Gabrielle Joseph of Rede Partners sits down with Real Deals to discuss the key fundraising trends she expects to see this year

End of Year Review: Pawel Gierynski, Abris Capital Partners

Pawel Gierynski, managing partner at Abris Capital Partners believes that private equity needs to embrace uncertainty and get back to basics

End of Year Review: Ulrik Smith, FSN Capital Partners

Ulrik Smith, co-managing partner at FSN Capital Partners, sees decarbonisation continuing to shape the PE landscape in 2024

Portco bankruptcies: Sniffing out danger

With corporate bankruptcies on the rise, there is concern that private equity portfolio companies could be swept away by the insolvency wave. Shivani Khandekar investigates how managers and lenders can collaborate to keep the wolves at bay

GP Profile: Maven Capital Partners

Partner Tom Purkis sits down with Real Deals to reflect on the SME investor’s journey and his ambitions for the new year

End of Year Review: Krzysztof Kulig, Innova Capital

Krzysztof Kulig, senior partner at Innova Capital, discusses latest fund Innova/7, benefits of nearshoring for Poland, and PE’s growing role in managing its investments

End of Year Review: Dirk Markus, Aurelius

Dirk Markus, founding partner at Aurelius, tells Real Deals that PE has gone back to basics as financial engineering drops in importance

GP Profile: Three Hills

Managing partner Mauro Moretti tells Real Deals there are no coincidences in the PE world

End of Year Review: Matt Smith, Foresight

Matt Smith, partner at Foresight, explains how the GP has remained active in the current environment and what he expects to see next year