Consumer Report 2023: PE firms finding opportunities despite cost-of-living squeeze – Real Deals Data Hub

According to the latest data from the Real Deals Data Hub, 1,136 investments worth more than €113bn have been recorded involving European consumer-focused companies between Q1 2021 and the end of Q3 2023. In proportional terms, dealflow in the consumer sector equated to about 14% of the whole market by volume and 16% by value, ranking it third overall behind the TMT and business services groupings, and marginally ahead of industrials.

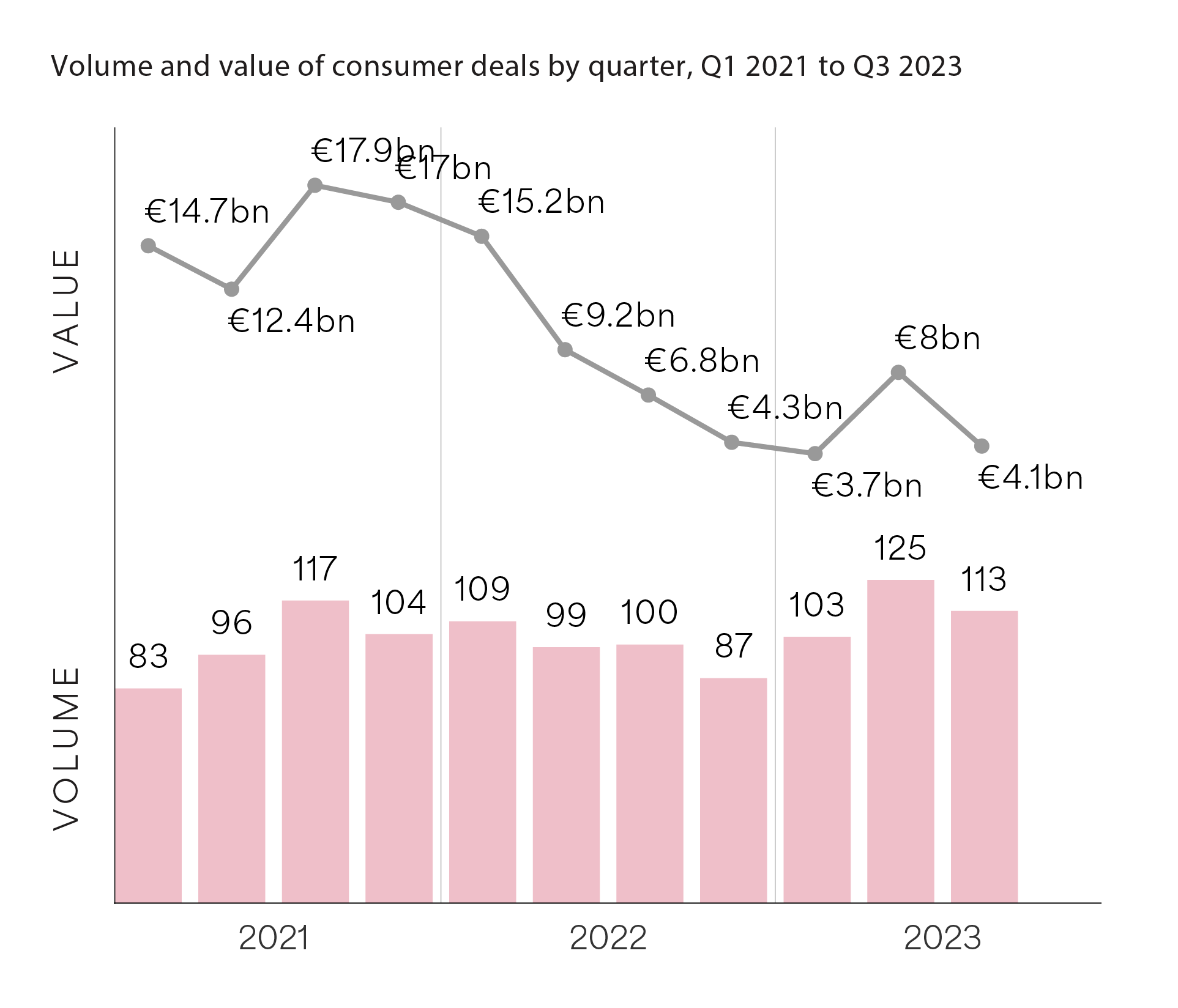

In volume terms, although consumer dealflow during the period covered has witnessed peaks and troughs, activity has been much more stable than in other key sector groups. And the recent trend has been upwards, with the average number of consumer deals per quarter sitting at about 100 in 2021, a fraction lower in 2022, but rising to about 113 for the three quarters of 2023 to date. It has to be pointed out, though, that the market in 2022 and 2023 has been somewhat propped up by the VC space; if that is stripped out, the number of deals is trending clearly downwards.

The more notable feature of the stats is the sharp drop in the value of consumer deals being done

The more notable feature of the stats is the sharp drop in the value of consumer deals being done. While the value trend line can always be somewhat misleading because of the presence (or absence) of deals at the top end of the market, the overall picture for the consumer space is clear: with values peaking at the back end of 2021, the sector has seen a sharp drop since the beginning of the Ukraine crisis, affected by all of the negative macroeconomic ripples that have spread out from that. Average quarterly value has slumped from about €15bn in 2021 to less than €9bn in 2022, and then to just over €5bn in 2023 to date.

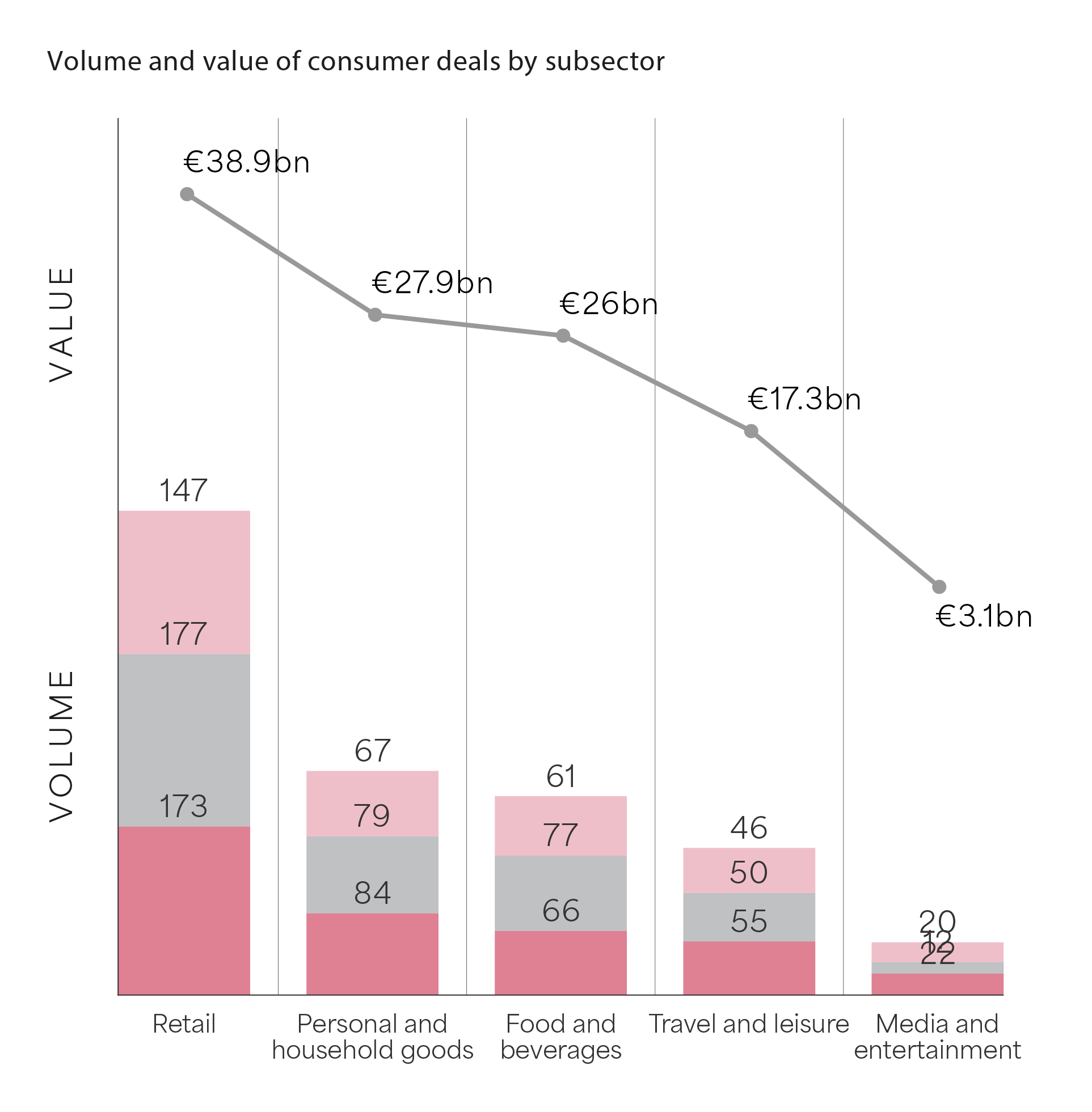

While the macroeconomic situation might explain the drop in capital being put to work, it is interesting to note that the sector as a whole continues to be driven by the retail space, which also includes specialised consumer services. In total, retail-related deals make up almost 44% of the consumer sample, well over double the other sub-sectors.

At a time where consumers are increasingly feeling the pinch due to inflation and sharply rising energy costs, it is clear that companies that offer strong value propositions to consumers are increasingly prominent

At a time where consumers are increasingly feeling the pinch due to inflation and sharply rising energy costs, this might seem counterintuitive, though looking at the businesses backed during the period, it is clear that companies that offer strong value propositions to consumers are increasingly prominent: from recipe-based meal delivery services to retailers of discount or second-hand products and other circular economy firms, there is a strong emphasis on value. And although there is still activity at the luxury end of the market, the value end of the spectrum will likely continue to figure strongly.

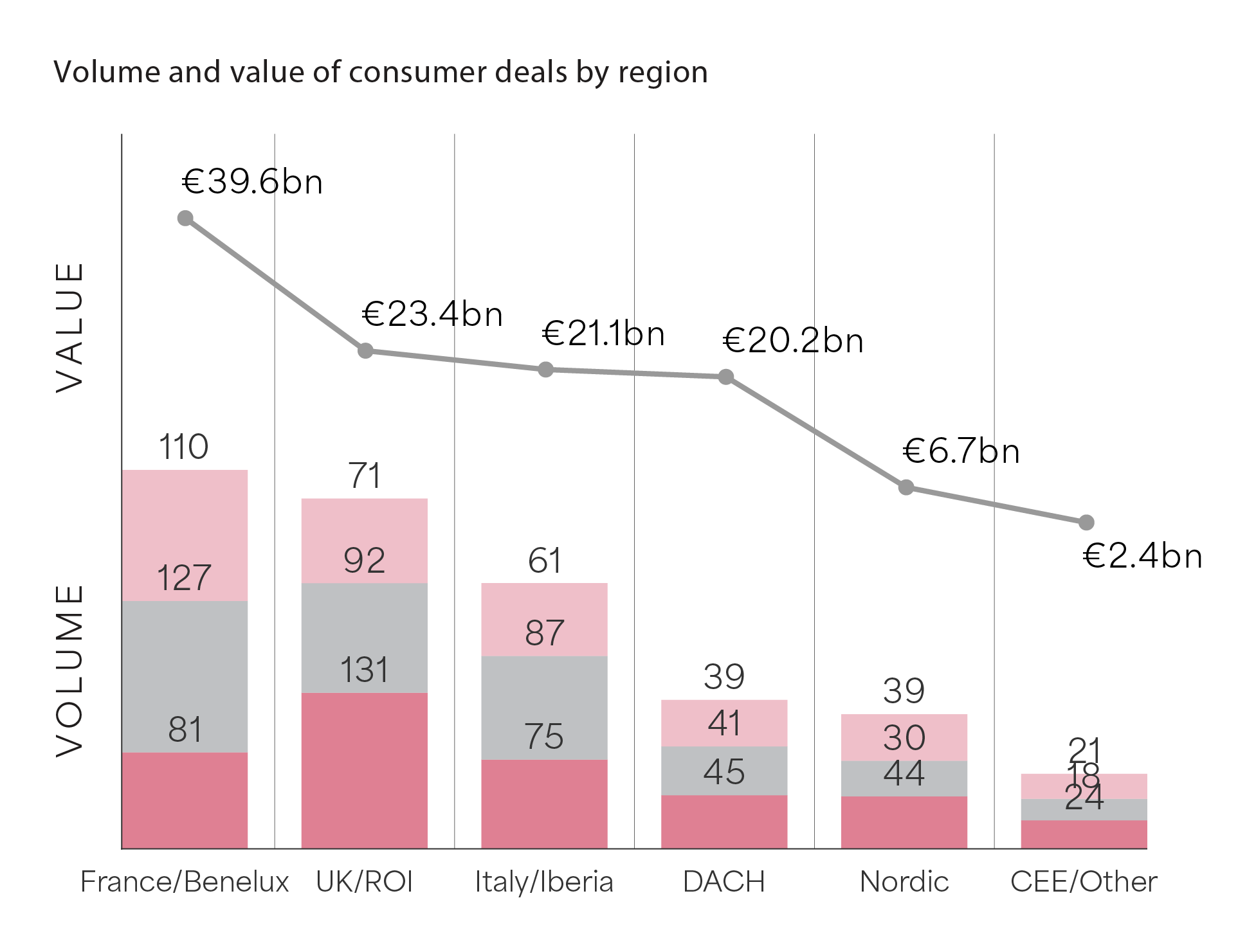

Consumer activity by European region

The France/Benelux region has led the way in consumer terms, with 28% of European deals by volume and 35% by value. What’s more, it has grown strongly during the period covered, rising from 81 deals in 2021 to 127 in 2022, and 110 to the end of Q3 2023. Of the 318 deals recorded, more than 45% were seen in the retail sub-sector, closely mirroring the overall European average. That said, it was deals in the food and beverages space that significantly drove the regional value, with the acquisitions of Refresco and Ekaterra in the Netherlands, and Solina in France, contributing more than €13bn to the total.

Although the UK/ROI was not far behind the France/Benelux total, the activity trendline is reversed, with the volume of deals in the consumer space falling from 131 in 2021 to 92 the following year. However, at 71 in the first three quarters of 2023, it looks on track to match the previous year’s total. In terms of value, the slump is even more pronounced as larger deals have evaporated, dropping from €18bn in 2021 to just €2.4bn in 2022 and €2.7bn in the year to date. Only five €1bn+ deals were recorded in the region – all in 2021, with the €3.5bn deal involving pet care provider IVC Evidensia being the largest.

In relative terms, the Italy/Iberia region outperformed other areas, generating almost 20% of consumer-focused deals and 19% of total invested. Unlike other regions, the clear driver of dealflow in Italy/Iberia is the food and beverage space, which produced more than 30% of transactions (mostly smaller and midmarket). The reverse is true of the DACH market, which is much more focused on industrials, services and TMT. Here, only 125 deals worth about €20bn were recorded – 11% of the European total by volume and 18% by value. The standout deal in the region was the €4bn buyout of Birkenstock by L Catterton.

The Nordic market came close to matching DACH totals, with 113 deals reported, though at less than €7bn it generated only 5% of the total by value. Here the distribution of deals closely matched the overall European picture, with retail companies making up 45% of the total. The CEE region is the smallest, in line with its overall standing in the European market, with 43 consumer deals worth €2.4bn reported. The largest deals (Pet City, Maxbet Romania, Vinted) all took place in the retail space.

Consumer activity by subsector

Despite the well documented macroeconomic headwinds facing consumers across Europe, retail-related deals make up almost 44% of the consumer sample by volume and 34% by value.

Although many of the 497 deals that were recorded in the space were in smaller and mid-cap brackets, the €38.9bn of aggregate value was driven by several significant deals in the area, including the €3.7bn buyout of Zooplus in Germany and the c.€1.7bn MBO of Instabee in Sweden. Other major deals involved investments in Arcaplanet/Maxi Zoo and Lovehoney Group – both of which were known or estimated to be worth €1bn+.

Despite the well documented macroeconomic headwinds facing consumers across Europe, retail-related deals make up almost 44% of the consumer sample by volume and 34% by value

While the personal and household goods space was much less active in terms of the number of deals recorded (230, or 20% of the market), it recorded some of the largest consumer deals in the period, driving overall value to nearly €28bn, or 24% of the total. Standout deals included the buyout of Birkenstock and multibillion-euro investments in IVC Evidensia and Belron.

The same is true of the food and beverages and travel/leisure sub-sectors, which between them only generated 30% of all deals by volume (355) but almost 40% by value (€43.4bn). This is largely due to a slew of very large transactions in the space, including the above-mentioned Refresco and ekaterra (Unilever’s tea business) deals in the Netherlands (€11bn+ between them), Valeo Foods in the UK and a trio of transactions involving football clubs or leagues in France, Italy and Spain, which are estimated to have added €5.4bn to the total.

The media and entertainment sub-sector, which has a significant crossover with more tech-related sectors, is the smallest grouping within the consumer space. During the period covered, the sub-sector produced 54 deals worth €3.1bn in total, a third of which is estimated to have come from the SBO of publishing business Springer Nature by Neuberger Berman and EQT. Other prominent deals featured video-game developers (Jagex) and music platforms (Epidemic Sound).

This article was first published in the Real Deals Consumer Report 2023. Click here to read the full report (no subscription required).

This content is free for all our visitors.

Would you like to check out the rest of our fantastic offering? Get in touch with us to discuss our trial and subscription options.

Contact us