Critical Content

Profile: Fondo Italiano d’Investimento celebrates raise of €1.2bn despite headwinds

Senior partner Gianpaolo Di Dio speaks to Real Deals about what makes the perfect deal and the current Italian PE landscape

Deal in Focus: Resilience of cinema software provider Unique X delivers ‘successful exit’ for BGF

Unique X managed to nearly triple its Ebitda between point of investment and exit, BGF investor Spencer Woods tells Real Deals

Deal in Focus: GRO’s new portco DigitalRoute to follow same path as Tacton investment

GRO’s lead partner on the investment Lars Lunde speaks to Real Deals about its acquisition of the usage data management software provider

Comment: Secondary by name, not by nature

Thibaud Roulin, head of North America private equity, Pictet Alternative Advisors, explores three broad trends worth noting in private equity’s secondary market

Operational Technology Report 2024

The 2024 Operational Technology Report - with in-depth analyses of the latest tech state of play in midmarket PE, profiles of key operational leaders, and more - is now available to download on our sister publication The Drawdown

Deal in Focus: Automation a priority for Nexxus Iberia’s portco Creaciones Marsanz

Nexxus Iberia’s lead partner on the investment Juan Pedro Dávila speaks to Real Deals about its majority stake in the Spanish retail equipment manufacturer

Comment: Why private equity needn’t see impact investment as binary

Clearwater's Jo Daley on why impact should be viewed not as a binary investment strategy, but a chance to identify and amplify impact-led growth

GP Profile: MidEuropa’s ambitions for its 25th year

As the firm reaches a quarter century, managing partner Robert Knorr speaks to Real Deals on his ambitions for the year, and thoughts on strategy expansion and opportunities

UK regional dealflow: future growth stars?

After a lacklustre end to 2024, dealflow across the UK has enjoyed a strong start to the new year, with deal volumes up across almost all of the UK’s regions. Julian Longhurst charts the last 12 months in numbers

Midmarket stars in modest first quarter – Real Deals Data Hub

The market headwinds that led to a somewhat lacklustre end to 2023 appear to remain firmly in control into the new year, though activity in the midmarket saw a welcome boost in the period. Julian Longhurst reports

Exclusive: Apiary Capital closes oversubscribed fund

Managing partner Mark Salter reveals the factors that helped the firm win LP commitments and his advice on fundraising

Deal in Focus: EMH Partners eyeing up geographic expansion for newest portco

Speaking to Real Deals off the back of the firm's recent investment in Stonebranch, partner Jens Zuber says engagement with the company intensified towards the beginning of 2023

Fund in Focus: INVL’s Baltic vehicle with wider ambitions

Fund "will be the top choice for local and foreign investors who understand our region" says INVL's Deimante Korsakaite

Hidden gems

Dunport Capital’s Ross Morrow examines the lower midmarket – an overlooked and underappreciated segment of the private credit market

Staying competitive

MUFG’s David Rochford explains why Ireland is taking a greater role as an operational centre in the alternatives industry

Europe’s refinancing wave

GPs struggled to refinance portco debt in last year’s choppy markets. But with interest rates expected to come down, fortunes could be improving, as Xhulio Ismalaj reports

Deal in Focus: Progressio’s Archiva deal reflects focus on IT, but some sub-sectors ‘too fragmented’

Beatrice Capretti, partner at Milan-based Progressio, speaks to Real Deals about the "caution" required when shopping around for tech deals

Roundtable: Lending in times of volatility

In this discussion, we discover how lenders have kept deploying capital and supporting private equity firms in the face of stiffening market headwinds

Venture Views: Two Magnolias on a mission to embrace diversity every step of the way

Real Deals' Shivani Khandekar catches up with co-founders Jessica Rasmussen and Marie Korde to understand the importance of diversity in venture capital and what makes their firm stand out

Deal in Focus: Triton’s Norstat exit preparation started on ‘day one’

"Identify likely buyers early" is the firm's approach, Triton partner Daniel Björklund tells Real Deals

Deal in Focus: Apiary’s 4x return on sale of entertainment touring agent TAG worth the wait

Apiary's Mark Salter and ECI's Rory Nath speak to Real Deals about the exit

Debt set: part one – Bomb squad

Taku Dzimwasha investigates if private credit can sustain its allure amid rising concerns

Fund in Focus: Manulife Strategic Secondaries Fund closes on more than €550m

The fund focuses on GP-led secondaries and has already commenced its deployment phase, global head of co-secondaries Jeff Hammer tells Real Deals

Climatetech’s second wind

Climatetech has emerged as a pivotal sustainability investment theme for private equity. Xhulio Ismalaj explores the journey climatetech businesses have been through in the midmarket and finds out why the future for the subsector remains hopeful

Making an impact

Sustainability and ESG factors have become a priority for GPs across the investment cycle. But does it pay to be sustainable? Silvia Iacovcich reports

Fund in Focus: Turnstone’s latest haul to concentrate on buy-and-builds

Spun out of Argentum, Turnstone’s sophomore PE fund had a first close in December, co-founder Joachim Høegh-Krohn tells Real Deals

Deal in Focus: Literacy Capital picks up minority stake in Live Business Group

Literacy CEO Richard Pindar tells Real Deals that the opportunity came through its advisory network

Real Deals Sustainability Report 2024

In this special report, we explore how GPs are utilising sustainability as a value creation lever

Comment: Technology’s sustainability challenge

It is time to embrace the opportunities that come with the technology industry’s shortcomings, according to Bettina Denis, head of sustainability at Revaia

Gaining territory

Ireland’s ILPA set out to enhance the country’s appeal as a fund jurisdiction in 2020 but progress has been sluggish due to investors’ preference for Luxembourg. However, the Emerald Isle is now upping its game, as Shivani Khandekar discovers

Comment: PE taps into flourishing wealth management sector

With an ageing population and burgeoning market, Houlihan Lokey’s Christian Kent discusses the rise of private equity interest in the wealth management sector

Deal in Focus: Omni notches strong return with Vivup sale

The GP had not planned to exit so soon but an unsolicited bid from Great Hill Partners prompted it to consider the deal, partner Elissa von Broembsen-Kluever tells Real Deals

Technology Report 2024

Welcome to the first instalment of the Technology Report, which shines a light on GPs at the cutting edge of tech adoption for front-office functions, and the providers powering that transformation

Q&A: The digital edge

Yair Erez and David Poole, partners at Stanley Capital, discuss how the firm is using a combination of proprietary and third-party technology to accelerate target identification and expedite deal conversion

Q&A: A model idea

A bespoke solution was key for ECI’s deal origination process according to Suzanne Pike, partner and head of origination at the firm

Q&A: Building a tech Nexus

NorthEdge’s Lucie Mills and James Hales discuss how the mid-cap GP is using technology to support deal origination, identify potential deal targets and enrich various interactions

Q&A: A journey of discovery

Philippe Laval, chief technology officer at Jolt Capital, discusses its proprietary software platform Ninja, and reflects on the highs and lows of bringing the system to life

Q&A: Transforming with tech

David Floyd, vice-president at global investment firm Permira, talks to Real Deals about how the business is harnessing advanced analytics and AI to drive competitive advantage internally and in its funds’ portfolio companies

Going digital

Nicholas Neveling explores how GPs are harnessing big data and AI not only to boost portfolio company performance, but also to provide a competitive edge when it comes to sourcing and executing deals

The Private Equity Value Report 2024

Charting the fastest-growing private equity-backed companies in the UK, in association with BDO

GP Profile: Palatine tops £1bn for total funds raised

Founder Gary Tipper talks to Real Deals after the GP achieved the landmark and gives his forecast for the remainder of the year

Webinar: From confusion to clarity

Experts explain how GPs can support portcos in doing their CSRD double materiality assessment right

GP Profile: Lightrock

CEO Pål Erik Sjåtil sits down with Real Deals to discuss the firm’s new strategy and why he remains committed to private investments

Fund in Focus: How Axcel closed its largest fund to date

Despite its success, Axcel VII was impacted by the market conditions and the denominator effect, managing partner Christian Schmidt-Jacobsen tells Real Deals

In conversation: Kerry Baldwin, IQ Capital

The VC co-founder shares useful tips for women thinking of entering the venture capital industry

Fund in Focus: Mirova launches new €200m social fund

Marc Romano and Judith-Laure Mamou-Mani tell Real Deals that the fund has received €20m seed funding to kickstart it and make investments

Vulture: Dealcraft meets Minecraft, and The Name Game

The Old Bird's game for a laugh...

Guardians of capital

In February, Real Deals hosted a cybersecurity webinar in collaboration with Doherty Associates. During the discussion, experts in the space discussed the cyber threat, ways to mitigate it and how to respond when an incident occurs

The hunt for CFOs for PE-backed firms has become more volatile – Finatal

Managing director Jack Lane reveals the strategies PE firms are employing to tackle the CFO talent crunch

Exclusive: Tresmares to close third PE fund in March

The Spanish firm also plans to open new offices and launch additional funds, partner Ignacio Calderón tells Real Deals

Deal in Focus: Synova invests in Mecsia

Alex Bowden, partner, tells Real Deals that the GP acquired the target because of the firm’s consolidation potential and strong growth

GPs ride the data wave

Demanding LPs and AI advancements have moved the dial on data. But what does a data strategy during a holding period look like? Xhulio Ismalaj reports

IWD: Helen Steers, Pantheon Ventures

To celebrate International Women’s Day, Real Deals catches up with Pantheon partner Helen Steers to discuss what it means to be a woman in private equity

In conversation: Future Business Partnership’s founders discuss achieving B Corp status

Real Deals sits down with founders Tracey Huggett and Vish Srivastava to understand the motivation for the certification and how it will impact its talent and investment strategy

Deal in Focus: NorthEdge backs Contollo

NorthEdge director Liam May tells Real Deals that the deal origination was relationship-driven

Webinar: Guardians of capital

This discussion explores how PE firms can protect their portcos from cyber threats

Exclusive: Quilvest acquires Acuiti Labs

Thomas Vatier, partner and co-head of buyout, tells Real Deals that the investor plans on leveraging its transatlantic expertise to grow the business

Podcast: What do LPs want?

British Patient Capital’s Christine Hockley discusses the importance of patient capital, what VCs must do to appeal to LPs, and how GPs can build a value proposition that aligns with their investors’ interests

LP View: LPs seek ‘GP 2.0’ in challenging environment

In an environment where LPs have been wrestling with the denominator effect, reshuffling their portfolio allocations and contemplating new strategies for liquidity, Silvia Iacovcich explores what institutional investors are expecting from ‘GP 2.0’

Deal in Focus: Bridges Fund Management exits Vegetarian Express

Partner Emma Thorne tells Real Deals the GP first initiated an exit process in early 2020 but it was shelved when the pandemic struck

SFDR: Bridging the gap

The EC's SFDR consultation has increased the pressure on GPs and LPs to navigate the multitude of demands within their relationships. Silvia Iacovcich explores how the framework can be improved

Podcast: The struggles of ESG reporting

In this exclusive podcast, Real Deals reporter Xhulio Ismalaj is joined by Richard Burrett, chief sustainability officer at early-stage cleantech investor Earth Capital

Deal in Focus: Nordic Alpha Partners sells Spirii to Edenred

Senior partner Laurits Bach Sørensen tells Real Deals the GP’s “highly” capital-efficient strategy was key to the portco’s growth

Exclusive: Unigestion closes Emerging Manager Choice II Fund

In parallel, the fund has also notched its first exit

Changing lanes: continuation vehicles steering a new course in investment strategies

Industry experts are bullish on continuation vehicles as a viable exit route. But issues around pricing, fees and carry loom large. Real Deals speaks to secondary players to understand how these can be navigated to minimise conflicts of interest

Deal in Focus: Lightrock consortium completes take-private of Velocys

Real Deals speaks with Lightrock’s Kevin Bone to understand the dynamics behind the GP’s first take-private deal

Exclusive: Capvis pivots its investment strategy after calling off fundraise

The Swiss GP is transitioning to a deal-by-deal model to exclusively pursue succession-oriented transactions, managing partner Daniel Flaig tells Real Deals

GP Profile: Core Equity

Real Deals catches up with ex-Bain Capital alum and Core Equity co-founder Thomas De Waen to discuss the atypical GP’s strategy and why it prefers to stay away from PE’s traditional pass-the-parcel model

GP Profile: Arca Space Capital

CEO Ugo Loeser tells Real Deals the PE fund is currently assessing two new deals

Exclusive: Phoenix exits Global Freight Solutions

During a seven-year hold period, the GP helped double the firm’s revenue and profitability

Venture Views: Zebra Impact eyes smorgasbord of agrifood investment opportunities

Real Deals' Shivani Khandekar sits down with co-founder Fabio Sofia to understand the impact investor’s thesis and fundraising plans

GP Profile: Perwyn

Managing partner Andrew Wynn speaks to Real Deals about what makes the perfect deal and the firm's new office in Milan

Venture Views: Target Global co-founder discusses an up-and-down year

Real Deals sits down with Yaron Valler to get his perspective on down rounds, the firm’s Israeli investments and the outlook for VC in 2024

Deal originators part one: The art of the deal

Deal origination has come into its own as the macro environment has become challenging, prompting GPs to seek innovative strategies for deal sourcing and execution. Silvia Iacovcich examines how the originators have adapted to the new normal

Deal in Focus: Investindustrial forms Sammontana Group with €1bn revenue

The GP's founder Andrea Bonomi tells Real Deals that the GP is already looking at three US-based bolt-ons to expand the firm’s offering

Deal in Focus: BD Capital acquires controlling stake in TLC Worldwide

Andy Dawson, co-founder and managing partner, tells Real Deals the GP’s operator-led approach resulted in the partnership

Deal in Focus: Ambienta acquires Officine Maccaferri

Ambienta’s Mauro Roversi tells Real Deals the GP plans to support the firm via organic and inorganic growth

ESG Conference 2024: The biodiversity challenge

A panel on assessing biodiversity impacts explored how the emerging push for biodiversity risk mitigation is influencing investment decision-making. Xhulio Ismalaj reports on one of the key issues discussed

ESG Conference 2024: Leveraging the value chain

In the final panel on day one, industry experts explored how the value chain can drive transformational change. Silvia Iacovcich reports

ESG Conference 2024: PE’s ESG evolution

Real Deals held its ESG Conference on 30-31 January. On day one, industry experts explored how ESG has evolved to become a key part of GPs’ strategies. Shivani Khandekar reports

PE firms struggle with ESG reporting balancing act

With unending developments in ESG reporting, Xhulio Ismalaj asks: just how much transparency is midmarket PE able to live with? And is it all in vain?

Fund in Focus: Epiris Fund III holds final close on £1.044bn

Alex Cooper-Evans, partner, tells Real Deals the fund had strong re-ups from existing LPs

Deal in Focus: Enterprise Investors raises a glass to JNT Group sale

EI’s value creation thesis allowed to reposition the company and shift its perception, which resulted in scaling JNT’s market share from single digits to almost 20% in volume terms, partner Sebastian Król tells Real Deals

Flat final quarter caps off relatively solid year – Real Deals Data Hub

Deal activity in 2023 started slow but remained steady throughout the year despite challenges, especially for larger cap brackets, with impressive overall deal volumes. Julian Longhurst investigates the numbers

Fund in Focus: Fondo Italiano d’Investimento’s co-investment fund hits first close on €82m

Roberto Travaglino tells Real Deals that the investor hopes to reach its final close within 12 months

CEE Report 2024: Forging a partnership

Max Cancre, director at TA Associates, and Filip Berkowski, investment partner at MCI Capital, speak to Real Deals about how their collaboration has yielded success

CEE Report 2024: Building champions

Real Deals speaks to MidEuropa’s operating partner Alain Beyens about how the Central Europe private equity firm taps into its local expertise to create international success

CEE Report 2024: Getting down to work

Pawel Gierynski and Stephen Richmond of Abris Capital Partners talk to Real Deals about capitalising on opportunity in Central Europe with market knowledge, technology and ESG

Expert View: Are minority investments gaining ground on majority deals?

Debevoise & Plimpton partners E Raman Bet-Mansour and Dominic Blaxill, and Jake Grandison, associate, explore whether minority investments are set to become the new majority and what GPs need to consider before undertaking such deals

TMT Report 2024: Wired for investment

Chris Baker, Aylesh Patel and Oliver Schofield, investors at leading UK midmarket private equity firm LDC, on why TMT businesses remain an attractive opportunity for private equity and the key trends driving M&A in the sector

CEE: Road to recovery

Deal activity in CEE reignited in 2023 as the instability from the previous years started to dissipate. But will the recovery continue this year? Shivani Khandekar investigates

TMT Report 2024: Leading lights

Real Deals speaks to James Searby of Directorbank about how finding the right talent can boost the growth of technology businesses

Organic Growth: Foresight and Partners Group reveal their tech playbooks

In this Organic Growth special, we speak to Foresight and Partners Group about how the GPs’ value creation strategies led to their successful exits of Fresh Relevance and Civica respectively

TMT Report 2024: Turn the page

Amid increasing interest from tech investors in B2B information services, Xhulio Ismalaj explores the subsector

Q&A: Reimagining infrastructure

Real Deals catches up with MML Infrastructure’s co-managing partners Andrew Honan and Sharand Maharaj to discuss how private equity expertise supports the GP’s infrastructure strategy

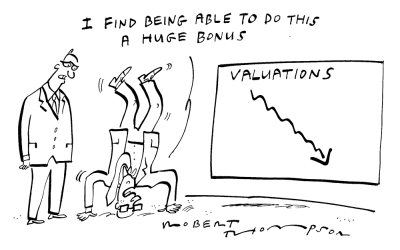

TMT Report 2024: PE investors go back to basics

Within TMT, tech tailwinds continue to attract PE to the space despite a valuation correction. GPs are now focused on revenue-generating businesses more than ever. Taku Dzimwasha investigates

Fund in Focus: Indigo Capital holds first close of third fund on €120m

CEO Monique Deloire tells Real Deals the firm aims to hold the final close of the vehicle by December 2024

Cobepa invests in SmartSD

The co-founders and management team will also reinvest in the firm as minority stakeholders

Comment: The craft of commercial due diligence

James Tetherton, senior partner at GRAPH Strategy, explains how CDD can make the difference in an increasingly complex deal landscape