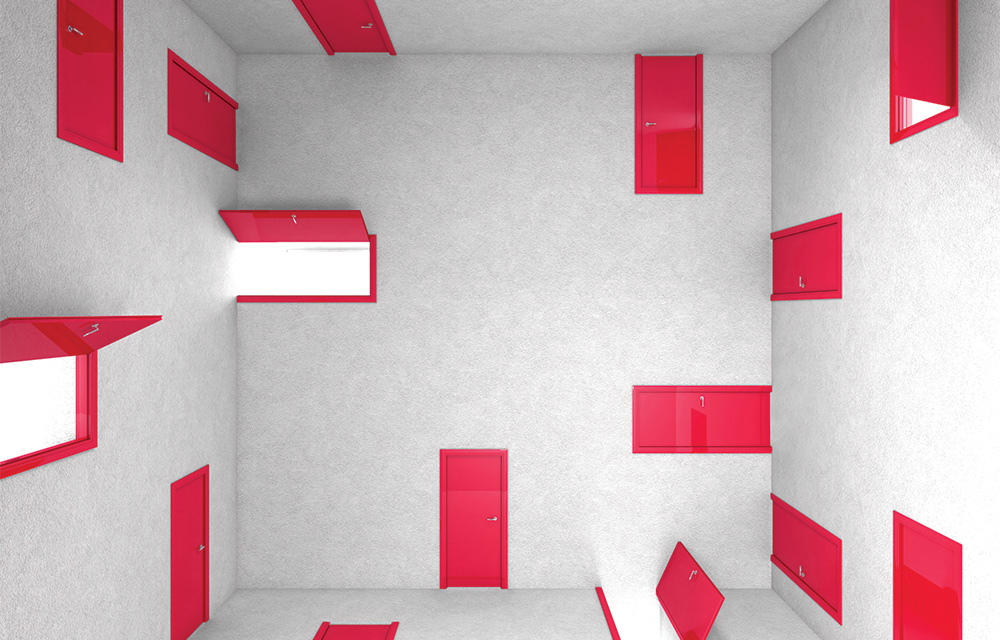

How GPs are adapting to the exit drought

Private equity has seen a slowdown in exits, with PitchBook’s Q3 2023 European Private Equity Breakdown estimating a total European PE exit count of 1,151 for the year, down on 2022’s figure of 1,497 and the 1,622 seen in 2021.

The valuation gap between a seller’s asking price and what buyers ultimately bid for an asset is a commonly cited explanation. As GPs look in the rearview mirror at yesteryear’s prices, some regret paying multiples of 10-12x ARR, which at the time was perfectly reasonable but has now dropped off a cliff.

Potential trade buyers are constrained by a stricter antitrust environment, with legislation such as the National Security and Investment Act being introduced in the UK.

These elements put fund managers in a tight spot; selling assets below value is a bitter pill to swallow, especially as returns perceived as unsuccessful can damage a firm's track record. While even large-cap firms struggle to raise the same amount as their predecessor funds, GPs need a strong performance to show their existing and prospective LPs.

So, with PE firms on realisation curves and their investors craving liquidity, the show must go on. And compounding that urgency is that many GPs can’t charge management fees if the asset is not out by year five, thereby impacting their carried interest.

Selling assets below value is a bitter pill to swallow, especially as returns perceived as unsuccessful can damage a firm's track record

What pressure?

Questioned about the pressure that comes with keeping the private equity cogs turning, Pablo Gallo, founding partner at Spanish GP Nexxus Iberia, responds: “Yes, you feel pressure sometimes, but does this mean that you have to or must sell an asset below the price? We would not do that. Instead, we would go to the investors, ask for a bit more time, explain why we might be holding the asset a bit longer, and then get the answer from the LPs.”

Tristan Nagler, a UK-based partner at carve-out specialist Aurelius, notes that there is undoubtedly economic pressure to generate value in portfolio companies. “Inaction is always undesirable but the need to be operationally engaged is essential now, as we have more cost inflation, higher interest rates, and the cost of debt rising. If you just run the models, you'll realise that profit gets eroded as cost rises, so if you do nothing, then your profits erode. And value erodes just from the cost of debt and the less amount of debt available,” he says.

To cope with the pressure, firms are looking to get any exits done. And even in a slower M&A environment where buyers are cautious and valuations are harder to bridge, bankers believe you can get a premium price for premium assets.

Graham Carberry, managing director at Arrowpoint Advisory, which looks after lower midmarket transactions at Rothschild, notes that less assets needing a story are being put on the table, with firms instead offering their "best" assets.

The need to be operationally engaged is essential now, as we have more cost inflation, higher interest rates, and the cost of debt rising

He says: “We have seen some sponsors take the approach of: ‘What always sells is a really high quality asset, so for areas we've got like subscription software businesses where there are high ARRs and very sticky customers, let's focus on that to get returns.’ That is obviously a bit of a bet.”

Firms have still found it possible to exit despite the difficult environment. Italian PE house Wise Equity, for instance, has sold seven portfolio companies in the last 12 months, which was approximately 50% of the total number of portfolio companies it had.

The GP’s founding partner Michele Semenzato attributes this to the firm's strategy of investing in ‘niche leaders’ – companies that he believes, during a market downturn, are more resilient and liked by banks.

“I tend to think that our companies tend to have a stronger strategic value than the average company, because they are the best company in a specific sector in what they do. Having that strategic value, I think it's easy to find a suitable buyer, even when the market is down,” says Semenzato.

“I'm not saying, however, that the situation in the market has not affected us in terms of the Ebitda multiples that we could obtain on the sale, but it’s just that the results were so good that we didn't worry about selling a company at 9x instead of 10x.”

My best side

But how are other GPs preparing to present their businesses in the best light for exit? For firms deciding to hold onto assets, they must remain productive, and they can do so through arranging another equity round in a portfolio company from its existing investors. Another option is doing quick bolt-on acquisitions to bolster the financial profile of the platform business.

“We have one portfolio company that is the leader in a sector in Europe, and we are hopefully buying the largest player in that sector in the US. It’s a company that we would have bought for a higher price last year than we are doing today because of this downturn in the market, so it's a good moment to look at these kinds of opportunities,” Semenzato outlines.

With the secondary market becoming better understood, as well as the extensive amount of dry powder in secondary funds, continuation vehicles are now a compelling option to hold an event for a portfolio company, particularly as investors increasingly seek such opportunities.

In May this year, Nexxus Iberia closed a €56m continuation fund to acquire its portfolio company, OFG Telecomunicaciones, which it had owned since July 2018 through Nexxus Iberia Private Equity Fund 1.

However, in this case, Nexxus Iberia’s Gallo says the business was growing, with OFG’s Ebitda having tripled under the GP’s ownership: “This continuation fund made sense for OFG. They wanted to keep growing and keep financial investors in the balance sheet. The team was really willing to do it, they were very much into it and they kept on pushing us. The money was there, the company was doing well. We, as a GP, wanted to be involved in the future of the businesses, as we really believe in it. So, it was very natural in this case.”

Louis Trincano, a former LP and managing partner at Cornerstone Fund Placement, which advised Nexxus Iberia on the fund, notes how continuation funds have changed, observing that the quality of GPs and assets has gone up significantly.

We're seeing some of the best GPs do continuations with their best assets so that there is an equity story going forward in the view of the investors that back these deals

“Go back 10 years ago when continuation funds started, it was typically the GPs that never managed to raise a successor fund. They did the first continuations with the assets that were left in that fund, which typically were not the best ones because the best ones get sold. Basically, you would have the worst GPs with their worst assets. They did the first continuations for assets that had been in portfolios for close to a decade,” says Troncano.

“Now, we're seeing some of the best GPs do continuations with their best assets so that there is an equity story going forward in the view of the investors that back these deals. Some companies reach their business plan two years ahead of schedule. Let's say that the five-year business plan is done by year two or three, then you start seeing some assets going to continuation pretty early – either because the M&A market is not there and/or the GP feels that there's an equity story to be had going forward that the M&A market does not buy at the time.”

Keeping your options open

Those seeing further growth potential in an asset and not wanting to walk away from it completely also have the option to realise some value sooner, which, while not ideal, LPs do appreciate.

Arrowpoint’s Carberry notes that PE firms retaining stakes on deals have become increasingly common, particularly among smaller sponsors struggling to deploy at the moment.

Positing a typical scenario faced by GPs in the current climate, he says: “It's one of their better assets and therefore they can announce something that looks pretty good. So, a GP might be in an asset worth, say, EV of €100m, but, actually, in the right market, it might be worth €125m. So, sell a bit now at €100m. You bought it for €40m, so you're still getting a fantastic return that you can talk about, but at the same time, you're not giving up your access to future growth on that.”

You need to prepare yourself for when the IPO market will be good again

Some, such as Wise Equity’s Semenzato, are still waiting on the public market route to open: “If you IPO a company today, you're going to leave a lot of money on the table. Maybe it is still worth doing it when it's mostly primary and you are not looking for a big capital increase, in terms of percentage of the entire capital, so you don't dilute your equity too much. You need to prepare yourself for when the IPO market will be good again. In our case, there is one company that we were planning to list just before the war in Ukraine and we are still holding it for when the market will be more receptive.”

To help alleviate the pressure, many sponsors yearn for interest rate stability, which indeed seems to be levelling out as we sit at or close to the bottom of the trough.

However, Aurelius’s Nagler points out that rates are still “very high” compared to what we have had for a long time. “That is the reality and it's going to be a number of years before they go back to where they were. It's more of a new normal. Naturally, we'll just get more and more comfortable and familiar with how we’ve got to get on,” he concludes.

Categories: Insights

This content is free for all our visitors.

Would you like to check out the rest of our fantastic offering? Get in touch with us to discuss our trial and subscription options.

Contact us