NO RESULTS

Naxicap Partners has acquired a majority stake in ITAL Express Group alongside its director Patrice Claverie and the management team.

CAPZA is reinvesting in the operation alongside co-investors Nord Est Expansion, Euro Capital and CEGEE Capital.

Founded in 1975, France-based ITAL Express is a spare parts distributor for the maintenance and repair of vehicles and equipment, including industrial vehicles, utility vehicles, tractors and agricultural machinery.

Supported by CAPZA since 2019, ITAL Express has expanded ranges and diversified distribution channels, namely digital. It also completed bolt-on acquisitions with Consogarage in 2019 (garage equipment and tools), Anjou Diffusion in 2020 (technical bearing and transmission parts for agricultural machines) and DPM Motis in 2023 (spare parts for gardening and forestry equipment).

French GP Naxicap Partners will look to diversify ITAL Express’ offering, both by supporting organic growth and through new acquisitions in France and internationally.

ADVISERS

Buyside

UBS (corporate finance)

Deloitte (financial due diligence)

Roland Berger (commercial due diligence)

Edge Avocats (legal)

Keels Avocats (legal)

Nabarro Beraud (legal)

Sellside

Alantra (corporate finance)

Piotraut-Giné Avocats (legal)

Eight Advisory (financial due diligence)

Indéfi (commercial due diligence)

Categories: Deals Exits Sectors Engineering Manufacturing Retail, Consumer & Leisure Geographies France & Benelux

Squire Patton Boggs has appointed Chris Hastings as a partner in its financial services practice group in London.

Hastings joins from Eversheds Sutherland, and is a finance lawyer focused on leveraged and acquisition financing.

He acts for private equity firms and their portfolio companies, corporate borrowers and private credit funds in relation to transactions at all levels of capital structures.

His recent work includes acting for Inflexion on its acquisition of a minority stake in The Goat Agency (and its subsequent sale to WPP); for Aurelius on its carve-out of UK property services provider TM Group from Dye & Durham; and for Pollen Street Capital on its acquisition of Assessio.

On the private credit side, he has advised the London-based teams of Tresmares Capital and Eurazeo on midmarket direct lending mandates to support domestic and international PE-backed businesses.

Categories: People Advisory moves Geographies UK & Ireland

Baltic-focused private equity firm Livonia Partners has invested in supply chain IT solutions provider Telema via its €157m Fund II.

Telema is an operator of electronic data interchange (EDI) and e-invoicing operator in the Baltics, offering IT solutions for automated data flow in the supply chain.

From its offices in Tallinn, Riga and Vilnius, Telema transfers, converts, monitors and processes electronic trade documents such as orders, invoices, delivery notes and other commercial documents. More than 5,500 shops and 1,500 suppliers use Telema's EDI network.

The company’s clients span 68 countries including the Baltics, Nordics, Germany, Japan and Australia.

The GP's previous investments include employee wellness benefit platform Stebby, heat pump and green home climate solutions provider Bestair, and communication solutions provider Wildix.

Livonia Partners, established in 2015, counts Swedbank, the European Bank for Reconstruction and Development and the European Investment Fund among its LPs.

ADVISERS

Cobalt (legal)

PwC (financial and tax due diligence)

Categories: Deals €200M or less Sectors TMT Geographies Central & Eastern Europe

Archimed-backed Carso has acquired three firms: Arace Laboratori, AQCF and a carve-out from diagnostic group AC Environnement.

Based in Vénissieux, France, Carso specialises in purity testing in the environment, healthcare, food, pharma, criminal forensics and health-at-work sectors.

Founded in 2007, Arace Laboratori is an Italian environment and food safety testing group; AQCF is a French-based food safety group that provides consulting services; while the corporate carve-out comprises the grouping of three high-capacity asbestos testing laboratories acquired from French real estate environmental diagnostics group AC Environnement.

Archimed funded the acquisitions alongside shareholders CAPZA Flex Equity Mid-Market and Siparex.

The acquisitions were financed with equity injections by the shareholders and a debt facility provided by Tikehau Capital, established for the company by majority owner Archimed.

Archimed said the acquisitions will allow Carso to consolidate the business's presence in the food purity testing market. In terms of value creation, the GP will support Carso in strengthening and expanding its footprint across Europe, while consolidating its presence in France.

The M&A operation brings the total number of acquisitions completed by Carso under current ownership to five, and follows the acquisitions of Italy-focused food safety specialist Agro.biolab, and French environmental testing laboratory Analy-co.

Several potential deals are also in negotiation, the GP said in a statement.

Archimed acquired Carso through its now fully invested MED Platform I fund, which closed with commitments of €1.5bn in 2020, reported at the time as a record for the PE healthcare-focused firm.

Since Archimed's acquisition in 2021, Carso's annual revenue has risen 33% to €255m in the current fiscal year, the GP said in a statement.

The fund and its successor, MED Platform II, which closed at €3.5bn in June, seeks opportunities in the European and North American mid-cap healthcare sectors, buying majority stakes between €100m and €500m.

With €8bn of AUM, Archimed focuses exclusively on healthcare industries, eyeing sectors such as biopharma products, consumer health, healthcare IT, in-vitro diagnostics, life science tools and biologic services, medtech and pharma services.

Categories: Deals €200M or less Sectors Healthcare & Education Geographies France & Benelux

Central European investor Innova Capital has closed its latest fund Innova/7 on €407m, surpassing both its initial €350m target and €400m hard-cap.

The fund attracted commitments from foreign institutional and commercial investors from Europe and North America, as well as Polish investors, whose total share is now more than 25%.

Innova/7 will target digitisation and modern technology integration in the business and financial services, industrials, and consumer and lifestyle (including healthcare) sectors.

The GP, which operates from Poland, typically invests in buyouts in midsized enterprises.

The first of Innova/7's investments was completed in May 2023 when the PE firm acquired NETOPIA Group, a Romanian payment services provider.

Subsequently, Innova Capital invested in R-GOL, a multi-brand distributor of football merchandise; EMI Group, which provides gate and handling systems; Pfleiderer Polska, a wood-based boards manufacturer; Dimark Manufacture, which supplies baggage handling systems automation business; and CloudFerro, which provides cloud services to the European space sector.

Innova has fully divested Innova/5 and completed its first large exit from Innova/6. The firm plans to use the sixth fund's remaining assets for further add-on acquisitions within the existing portfolio.

Since its inception in 1994, Innova has invested close to €1.4bn in almost 70 companies across 10 countries in the Central Europe region.

Innova senior partner Krzysztof Kulig was responsible for the fundraise.

Categories: Funds Mid [€200M - €1B] Sectors Business Services Construction & Infrastructure Energy & Environment Engineering Finance & Insurance Healthcare & Education Retail, Consumer & Leisure Geographies Central & Eastern Europe

UK PE firm Rockpool Investments has invested in Scottish software consultancy firm 2i Testing.

Headquartered in Edinburgh, 2i provides engineering services that de-risk digital transformation programmes.

Rockpool typically provides funding of between £5 and £15m to profitable, UK-based private companies.

The PE firm said it has been impressed by 2i’s "proactive" investment in people and automation products, as well as its "strategic partner approach" to working with clients.

The funding will assist 2i by expanding its service and product range organically and via bolt-on acquisitions.

Rockpool has invested more than £675m since inception. Its 2i investment was led by Guy Nieuwenhuys and Will Beckett.

ADVISERS

Rockpool

Stephenson Harwood (legal)

Saffery (financial due diligence and tax)

Palladium Digital (technical due diligence)

Continuum (organisational due diligence)

Claritas (tax)

2i

Moore Kingston Smith (corporate finance and tax)

Bird & Bird (legal)

Categories: Deals €200M or less Sectors Business Services TMT Geographies UK & Ireland

Abris Capital Partners has sold 100% of the shares in Polish healthcare provider Scanmed for an undisclosed sum.

Scanmed has been bought by the American Heart of Poland Group, which is backed by the Italian hospital group Gruppo San Donato.

Headquartered in Warsaw, Scanmed is the largest privately owned diversified in-patient group in Poland, operating 37 facilities across the country, including seven hospitals and 18 medical centers.

Abris acquired the business in November 2020 via its €500m Fund III.

During Abris’s ownership, the company introduced new therapeutic areas and grew the scale of multi-profile hospitals.

The firm also supported Scanmed with an ambitious buy-and-build programme, completing the add-on acquisitions of Ars Medical in 2022, Med-Lux in 2023, and Centrum Rehabilitacji in Chorzów and Vital Medic in 2024.

ADVISERS

Greenberg Traurig (legal)

Deloitte (corporate finance and tax)

Categories: Deals Exits Sectors Healthcare & Education Geographies Central & Eastern Europe

German investment firm Quantum Capital Partners (QCP) has completed the sale of Leichtmetall Aluminium to UAE-based Emirates Global Aluminium (EGA).

Leichtmetall, which generated revenue of €250m in 2022, is a German specialty foundry, producing standard and large diameter hard-alloyed aluminium billets, utilising a high proportion of recycled aluminium as input material. Leichtmetall has customers in Germany, Italy and France.

QCP acquired the company in 2014 as “an underperforming asset”. During the last 10 years, Leichtmetall increased its staff by 50%, tripled its revenues and increased operating profits by 1,500%, the firm said in a statement.

The deal, first announced in March, is EGA’s first major acquisition since it was formed through the merger of Dubai Aluminium and Emirates Aluminium a decade ago.

EGA produces premium aluminium, with operations from bauxite mining to cast primary aluminium. Last year, EGA sold 2.75 million tonnes of cast metal to more than 400 customers in over 50 countries.

Abdulnasser Bin Kalban, chief executive at Emirates Global Aluminium, said the acquisition of Leichtmetall adds significant value to EGA, alongside the recycling facility it is building in Abu Dhabi.

Based in Munich, QCP specialises in corporate carve-outs.

ADVISERS

QCP

Houlihan Lokey (corporate finance)

TRACC Legal (legal)

Categories: Deals Exits Sectors Manufacturing Geographies DACH ROW

Nordic private asset firm CapMan, through its special situations strategy, has become the majority owner in infrastructure construction business TerraWise.

The company’s key personnel will remain significant minority owners.

Operating in Finland's Uusimaa and Pirkanmaa regions, TerraWise's operations focus on landscaping and urban construction, land and infrastructure construction, and excavation.

The company's clients are primarily cities and municipalities, housing cooperatives and construction companies. It employs close to 160 people.

TerraWise said it turned the business back to profitability during the past year and a half, and has significantly built up its order book during the first half of 2024.

CapMan, which has more than €5bn in assets under management, said its objective is to strengthen TerraWise’s position in the green and urban landscaping and infrastructure construction space.

Tuomas Saarinen will continue as the portfolio company’s CEO.

Categories: Deals Sectors Construction & Infrastructure Geographies Nordics

Few industries had a tougher hangover from the Covid-19 pandemic than cinema chains. For those that emerged intact from the lockdown periods, encouraging customers back into theatres and away from their new-found allegiance to streaming sites proved an extended challenge.

Helping the chains meet that challenge – one that further intensified as inflation pushed up running costs – has proved a fruitful endeavour for BGF, which last week announced a successful exit from digital cinema software solutions and service provider, Unique X.

Unique X successfully scaled its operations and proved to be "incredibly resilient", including during the Covid-19 pandemic, Spencer Woods, investor at BGF, tells Real Deals. The portco managed to nearly triple its Ebitda from the point of investment to exit, he says

“Despite the impact of Covid-19 on the business, during our six-year holding period Unique X continued to perform well, winning several new contracts, evolving its product offering and expanding internationally,” notes Woods.

According to Harvard Business School research published in 2020, PE managers believed that 40% of their portfolio companies would be moderately negatively affected and 10% could be very negatively affected by the pandemic.

In April, BGF announced the exit of its investment as the Manchester-based business secured a new deal of up to $80m in a Series-C funding round, securing commitments from Kartesia, a pan-European specialist provider of financing solutions for SME companies.

Despite the impact of Covid-19 on the business, during our six-year holding period Unique X continued to perform well, winning several new contracts, evolving its product offering and expanding internationally

Spencer Woods, investor at BGF

“It’s another great example of BGF’s investment model, which allows us to form long-term, minority-led partnerships with ambitious businesses and management teams looking to scale. This exit has delivered a strong return on our investment and we wish the business all the best on the next stage of its journey,” Woods says.

Two-years observation

Unique X provides intelligent autonomous cost-saving solutions and revenue-generating fully managed content services, operating in 90 countries across the globe, delivering more than 200,000 movies and 1.1 billion cinema advertising spots per year. It cites 20th Century Fox, Odeon Cinemas and Warner Bros among its clients.

Woods highlights that BGF first became aware of Unique X in 2016, and monitored the company for two years.

“We first became aware of the firm following an introduction through our adviser network. We maintained contact and were impressed by the technology and progress of the business scaling, before completing a £15m investment in 2018,” the investment professional highlights.

According to the allocator, Unique X represented an attractive investment proposition thanks to an experienced management team, a highly scalable, profitable and cash-generative business model, and a clear focus to expand internationally.

“The company also had a strong customer base, underpinned by long-term recurring revenue contracts and an excellent market position,” he adds.

The value creation strategy was based on four pillars.

“Our strategy was principally driven by continued growth of the company’s software revenues. In addition, the business focused on investing in new technologies, expanding its suite of products and growing its customer base globally,” Woods highlights.

We first became aware of the firm following an introduction through our adviser network. We maintained contact and were impressed by the technology and progress of the business scaling, before completing a £15m investment in 2018

Spencer Woods, investor at BGF

In September 2021, the digital entertainment specialist announced the acquisition of Switzerland-based theatrical content services company Diagonalfilm, with the intention to further expand its services and strengthen the Swiss cinema ecosystem.

A robust pipeline

When asked about BGF’s current pipeline, Woods reveals an appetite towards the UK and believes in the growth potential of the North of England.

According to the allocator, the region has a strong reputation in sectors including tech, education and healthcare, with the GP expecting these to remain resilient in the future.

“As with any difficult economic backdrop, strong, well-capitalised businesses in resilient sectors will find opportunities to seize market share, particularly from less nimble, over-leveraged rivals,” he explains.

“As a patient, long-term investor, we aren’t constrained by timeframes associated with typical PE houses so we can focus on driving growth and value creation, enabling portfolio companies to realise their potential at a timeframe best suited to their needs,” he concludes.

Set up in 2011, BGF has since then invested £3.9bn in more than 550 companies, making it the most active investor in the UK and Ireland. BGF is a minority, non-controlling equity partner.

The GP recently completed a multimillion-pound investment in sports marketing business Eleven Media and has also recently announced its sale of Hydrock, a London-based multi-award-winning engineering design, energy and sustainability consultancy.

Categories: Deals Deals in Focus Exits €200M or less Sectors Retail, Consumer & Leisure Geographies UK & Ireland DACH

Goldman Sachs Alternatives is to take a majority stake in French independent wealth manager Crystal.

The acquisition comes four years after Seven2, formerly Apax Partners, acquired a majority holding in Crystal. Seven2 will retain about 25% in the wealth manager alongside GS Alternatives' private equity business and Crystal’s management team, led by Bruno Narchal and Jean-Maximilien Vancayezeele.

Crystal was founded in 1992 and completed 26 build-ups in the period since Seven2's investment. It recently announced it would acquire French investment solutions provider Primonial Ingénierie & Développement, financial advisory Opti Finance and wealth management consultant RDFI.

Following completion of the latest acquisitions, Crystal will have AUM of €22bn, revenues of €300m and a client base of 90,000 families served by 1,000 employees.

ADVISERS

Seven2

Weil, Gotshal & Manges (legal)

Goldman Sachs Alternatives

Latham & Watkins (legal)

Categories: Deals Exits Sectors Finance & Insurance Geographies France & Benelux

Hypax has carved out Precision Colour Printing (PCP) from Claverley Group, a Midlands-based media group.

Formed in 1979 and headquartered in Telford, PCP provides commercial printing, finishing and fulfilment services to publishers and holiday companies. The company has 200 employees across its four UK sites.

London- and Berlin-based investment firm Hypax specialises in midmarket corporate carve-outs.

The investor said PCP has been impacted by effects of the Covid-19 pandemic on the printing market, exacerbated by rising energy costs and input prices, which is in line with the wider industry.

This transaction will enable the business to refocus efforts, which includes further investment in product workflow improvements and energy efficiency to reduce its cost base.

The buyer said Claverley Group decided to dispose of PCP to focus on its core business activities. The seller will continue to be a customer of the business.

Categories: Deals Sectors Business Services Manufacturing Retail, Consumer & Leisure Geographies UK & Ireland

Bluewater has sold subsea operations specialist Rovop to US-based marine transportation business, Edison Chouest Offshore.

Based in Aberdeen, Scotland, Rovop is a provider of remotely-operated vehicle (ROV) services to the energy sector.

Midmarket PE firm Bluewater focuses on the energy sector and currently manages $2.5bn across a portfolio of 19 companies.

The GP first backed Rovopin 2017 through its second fund, before investing further in the business alongside then part-owner BGF in 2020.

Bluewater subsequently assumed full ownership in September 2022 and facilitated a $25m investment from Canadian global infrastructure and real assets manager Cordiant Capital, with a view to spur continued growth.

Rovophas has expanded internationally and enhanced its operations in low-carbon industries since its investment, according to Bluewater.

For the fiscal year ending 31 March 2023, Rovop reported a 31% increase in revenue, reaching £53m, and is expected to report continued growth in the following year, according to the seller.

Categories: Deals Exits Sectors Energy & Environment Geographies UK & Ireland

Dutch investor Nordian has acquired Goedhart Convenience and Qizini to create a new European player in the convenience food industry.

The two firms are being spun off from their existing parent companies to form a single group catering to the Benelux region.

Goedhart Convenience produces pre-packed convenience food concepts for the retail, gas station and food service industries. The company has one production location in Leeuwarden, the Netherlands, and currently has around 100 employees.

The company was previously part of natural oil and fat solution provider specialist Goedhart & Borgesius Group, founded by the Borgesius family, which also invested in the deal.

Qizini produces fresh and frozen convenience food, such as sandwiches, wraps and hot snacks, aimed at the aviation and retail industries. The company has two production locations in Alphen aan de Rijn and Losser, the Netherlands, and currently employs around 250 people. The company was previously part of sushi and other convenience food products supplier Natsu Foods Holding GmbH & Co.

The new group aims to serve customers across a wide range of sectors, including retail, food service and aviation, the GP said in a statement.

Its value creation strategy will particularly focus on capitalising on themes such as automation and sustainability, while developing its product offering with an eye on customer experience.

The two companies together generate a turnover of approximately €145m, according to Nordian.

Founded in 2014, Nordian focuses on majority stake investments in medium-sized Dutch companies and has so far invested in more than 30 companies, and provides support in areas such as strategy, financing, and mergers and acquisitions.

The GP typically targets businesses with Ebitda of €3-15m, while ticket sizes typically start from €10m.

Categories: Deals €200M or less Sectors Retail, Consumer & Leisure Geographies France & Benelux

CapMan's Growth Equity III fund has reached its hard-cap of €130m.

The fundraise exceeds the size of the team's previous fund, CapMan Growth II, which closed on €97m.

CapMan Growth’s investor base consists mainly of Finnish institutional investors and entrepreneurs, including several founders of CapMan Growth’s portfolio companies.

The new fund will continue the strategy of its predecessor, offering Finnish entrepreneurs an alternative to selling the majority of their business, through a partial exit, while also supporting growth.

The Finnish growth investor will make "significant" minority investments in entrepreneur-led growth companies with revenues ranging between €10m and €200m.

Since its inception, CapMan Growth has invested mainly in technology-enabled service companies, technology and software companies, and healthcare.

The new fund made its first investment at the beginning of April when it invested in environmental technology company Tana.

Since 2017, CapMan Growth has raised more than €300m.

CapMan overall has more than €5bn in assets under management, employing about 200 professionals in Helsinki, Jyväskylä, Stockholm, Copenhagen, Oslo, London and Luxembourg. It has been listed on Nasdaq Helsinki since 2001.

Categories: Funds Small [€200M or less] Sectors Business Services Healthcare & Education TMT Geographies Nordics

PAI Partners has carved out the European rehabilitation business of Fresenius Vamed, a global provider of services for hospitals and other healthcare facilities.

Vamed is currently a fully consolidated subsidiary of Austrian healthcare company Fresenius. PAI – through its c.€920m midmarket fund – will hold a 67% stake and Fresenius will hold a 33% stake upon the completion of the transaction.

Vamed’s rehabilitation business operates 67 clinics and care centres across Germany, Austria, Switzerland, the Czech Republic and the UK, serving more than 100,000 patients annually.

The rehabilitation business has an enterprise value of €853m and generated revenues of about €1bn last year, according to statement by Fresenius.

The rehabilitation business is Vamed’s largest business unit. Its portfolio ranges from project development and planning to the total operational management of healthcare facilities and providing services to patients.

Similar investments by PAI in the healthcare sector include DomusVi, a European provider of residential elderly care.

The Vamed deal represents the firm’s 20th carve-out since inception.

ADVISERS

PAI Partners

Willkie Farr & Gallagher (legal)

Alvarez & Marsal (financial due diligence)

ISP Healthcare (commercial due diligence)

Fresenius

UBS (corporate finance)

Latham & Watkins (legal)

Categories: Deals Sectors Healthcare & Education Geographies DACH

Milan-based GP Arca Fondi and Italian investor Alto Partners have purchased 100% of Italian medication and cosmetic firm Eurosirel from founders Ernersto and Alberto Leonelli.

Headquartered in Milan, Eurosirel specialises in the production and marketing of devices for medication and cosmetics, with a customer base that includes large-scale retail trade operators, pharmacies, specialised retailers and pharmaceutical companies.

The deal was completed via a special purpose vehicle (SPV) controlled and managed on an equal basis by funds Arca Space Capital and Alto Capital V.

Arca Fondi is aiming for growth and international expansion of Eurosirel both organically and via acquisitions, Arca Fondi said in a statement.

Its value creation strategy includes the development of new products and proprietary technologies to expand its customer service capabilities, the GP added.

Eurosirel currently employs 130 people and posted a turnover of €62m in 2023, with an Ebitda of approximately €11m. Sales CAGR over the past 10 years was in excess of 10%, according to the statement.

Arca Space Capital held a first close in August 2023 at €130m and has a target size of €250m.

The Article 8 buyout fund targets investments with a focus on energy transition, ageing populations and the circular economy. Its target deal sizes range from €20m to €60m in companies with a turnover of up to €300m, and focuses on niche Italian sectors such as automotive machinery, components and pharmaceuticals.

The fund received backing from institutional investors thanks to its focus on the real economy, with big players such as Fondo Italiano D’Investimento supporting Arca Space Capital with two funds.

Read more about Arca Fondi’s view on the current Italian PE market landscape and its strategic approach to co-investment partnerships here.

ADVISERS

Arca Fondi

OC&C (business)

Giovannelli Studio Legale (legal)

Spada Partners (financial & tax)

Erm (ESG)

Eurosirel

Marcianesi & Associati (financial & tax)

Orrick (legal)

Categories: Deals €200M - €500M Sectors Healthcare & Education Manufacturing Geographies Southern Europe

The handling of a previous investment was instrumental in helping Danish PE firm GRO Capital clinch the acquisition of data management software provider DigitalRoute, the buyer's co-founder and lead investment partner tells Real Deals.

GRO Capital, which targets investment in Northern European b2b software businesses, acquired DigitalRoute from Swedish GP Neqst last week – investing out of its GRO Fund III, which closed on €600m in March 2022.

The firm intends to follow a similar value creation journey with DigitalRoute as it did with its investment in Swedish business Tacton, Lars Lunde says.

Lunde cites the PE firm’s Tacton investment – a 'configure, price, and quote' (CPQ) software provider which he backed in 2017 as lead investor through GRO Fund I and sold last summer – when pitching to DigitalRoute’s existing shareholders.

“It actually took a little bit of persuasion to get Neqst to sell,” says Lunde, noting that it was in ongoing discussions with DigitalRoute and the shareholders for a number of years.

It actually took a little bit of persuasion to get Neqst to sell

Lars Lunde, GRO Capital

Founded in 2000 and headquartered in Stockholm, DigitalRoute provides usage data management software, with its main areas of application being billing and revenue management. The company has more than 200 employees across its nine offices around the world, generating SEK400m (€34.3m) in turnover.

Neqst first backed DigitalRoute in 2008 - and in which it most recently held a 94% stake - according to the seller’s website.

The 16-year holding period can be attributed to Neqst’s open-ended fund nature, allowing the firm to hold assets for extended periods of time.

Lunde says Neqst had been through a “big journey” with DigitalRoute, supporting the company’s as it grew from its “solid” position within the telecommunication vertical into the evolving enterprise market. The seller also transitioned the business from on-premises to the cloud.

To convince the shareholders, GRO alluded to its active ownership model, which aims to add value by scaling the commercial and product side of the business. Given the growing market, it is an apt time to change hands to achieve that scale, says Lunde.

Angles

The partners behind Copenhagen-based GRO, which has approximately €1bn in AUM, have been investors in more than 25 technology and software-related companies across various verticals. The whole quote-to-cash value chain has been a strategic investment area at the PE firm for many years.

Tacton was also in the quote-to-cash value chain, specifically CPQ software.

“DigitalRoute is an important part of this value chain, especially when business models become complex and large scale,” says Lunde, noting that he has known DigitalRoute for many years.

With DigitalRoute, GRO says it is buying into the shift towards subscription and usage-based models, which it believes are transforming “many industries”.

The partner highlights DigitalRoute’s legacy in handling the complex data management task linked to telco subscriptions, with the telco sector having become usage-based very early on.

“It is an industry characterised by millions of users on various subscription plans roaming many networks. That creates a lot of data complexity, which needs to be managed and understood in an automated fashion to bill you in the right way,” he explains.

According to Lunde, many new verticals have ventured into usage-based business models during the last decade, such as the energy sector or the transportation sector, where there is an increasing number of car-sharing business models, which rely on usage-based pricing.

The holy grail for many verticals is to build recurrency through product-as-a-service business models, which will increase the need for user data management

Lars Lunde, GRO Capital

“The holy grail for many verticals is to build recurrency through product-as-a-service business models, which will increase the need for user data management,” the partner emphasises. “At its core, DigitalRoute is good at managing very complex datasets and ultimately dumbing them down to something that the billing systems can handle at scale.

“This is increasingly needed across many verticals. Many software solution providers have converted to subscription business models during the last decade and now many are considering introducing usage-based modules on top.”

DigitalRoute added that GRO is the “ideal partner” to help it expand its offerings to new and existing customer segments, citing the investor’s track record of supporting B2B software companies at strategic and operational levels.

The DigitalRoute acquisition is GRO’s sixth investment in Sweden, which is the GP’s second biggest market after Denmark. The firm’s geographic remit also includes other Nordic countries and DACH.

Categories: Deals Deals in Focus Sectors Business Services TMT Geographies Nordics

Limerston Capital-backed Cormica has acquired TPM Laboratories (TPM) in a seven-figure deal.

Founded in 2001 and based in New Jersey, TPM is a contract testing laboratory, delivering analytical services to the pharmaceutical and chemical industries, including analytical research and development, quality control, and stability storage and testing services.

Cormica is a UK-based medical device, combination product and pharmaceutical testing group that aims to support life science manufacturers and innovators to launch their products.

The firm said in a statement that the deal will allow it to focus on strategic expansion of its capabilities, service line offering and international footprint, with a particular focus on the US.

The GP added that it is "proactively" working on further acquisitions in Europe and North America.

As part of the acquisition, TPM founder Rupa Iyer will continue to lead her team in the US.

Limerston Capital acquired Portsmouth-based medical devices testing service provider WMP Group in September 2021. Dover-based tech laboratory Medical Engineering Technologies was acquired in May 2022, forming Cormica Group.

Founded in 2015 and with more than £300m of AUM, London-based Limerston Capital seeks opportunities in the UK midmarket arena. The firm targets businesses with Ebitda between £5m and £15m.

Last March, the GP announced the closing of its second fund on £245m. Read more about its strategic approach to deployment here.

Categories: Deals €200M or less Sectors Healthcare & Education Manufacturing Geographies UK & Ireland ROW

PwC has appointed Charles Chang as a partner in its corporate finance team in London, focusing on midmarket software M&A.

Chang, who has 20 years of experience and has advised on £20bn worth of software M&A deals in Europe, joins from digital economy-focused advisers Arma Partners, where he was a managing director.

While at Arma, he was involved in the sale of large software companies to private equity firms and international strategic buyers, and in portfolio acquisitions for clients.

Prior to Arma, Chang worked at the Canadian Bankers Association in Toronto and at the chemicals M&A firm Valence Group, now Piper Sandler, in London.

Categories: Sectors Business Services People Advisory moves Geographies UK & Ireland

Synova has generated a 3x return on the sale of its portfolio company MK Test Systems, following a 10-year holding period.

The company has been bought by London Stock Exchange (LSE) listed Halma, a British group of safety equipment companies making products for hazard detection and life protection.

In a filing to LSE, Halma said it has bought the company for £44m, on a cash- and debt-free basis. MK Test Systems' unaudited revenue for the 12 months to March 2024 was £12.4m.

The deal sees MK Test Systems become a standalone company within Halma's safety sector, led by its current management team.

MK Test Systems provides specialist automatic electrical testing software and services for OEMs and MROs within the rail, aerospace, and oil and gas sectors.

Synova backed the £20m buyout of MK Test in 2014.

According to the firm, it built a team around managing director Jason Evans; invested “heavily” in completely re-engineering MK Test Systems' solutions with new software and hardware platforms; and developed new, safety-critical solutions for the aerospace industry, as well as using entering new markets such as rail, oil and gas, and electric vehicles.

The company now has a presence in North America, Latin America and Asia.

ADVISERS

Synova

Stephens (corporate finance)

Osborne Clarke (legal)

KPMG (financial due diligence)

CIL (commercial due diligence)

Categories: Deals Exits €200M or less Sectors Business Services Geographies UK & Ireland

London-listed Bridgepoint Group is to invest in French risk manager Forward Global, in a deal that values the portco at more than €200m.

Bridgepoint, which will make the investment via its Bridgepoint Development Capital IV (BDC VI) vehicle, said the investment will help support Forward’s growth plans, specifically expansion into the US and M&A opportunities.

Founded in 2018, Forward provides risk management services in areas including cybersecurity, litigation and regulatory intelligence, and strategic communications. The firm has completed 10 acquisitions since its founding.

Forward announced last month that it had entered into exclusive negotiations with Bridgepoint over it taking a minority stake in the Paris-headquartered firm, alongside existing minority shareholders, RAISE Invest and Rives Croissance.

BDC IV, which targets lower midmarket firms, invests €40-150m per company and was raised in 2020. The latest transaction is its 16th platform investment – and the sixth in France – by BDC IV. Bridgepoint announced in January that BDC IV had made a strategic investment in British cloud and digital transformation services provider Kerv Group.

ADVISERS

Forward Global

Hogan Lovells, Axipiter, Schoups, Sheppard Mullin (legal)

LEK Consulting (strategic audit)

Oderis (financial audit)

Indefi (ESG)

Natixis Partners (corporate finance)

Callisto (management due diligence)

Bridgepoint

Proskauer Rose, Arsene Taxand, and DLA Piper (legal & structuring)

BCG (strategic audit)

KPMG (financial audit)

PwC (legal, tax, social, and ESG audits)

Clearwater (corporate fiinance)

Categories: Funds Deals €200M or less Sectors Business Services Geographies UK & Ireland France & Benelux

Bruin Capital has acquired a majority stake in Dutch tech firm PlayGreen.

The deal values the company at more than $100m, according to media reports.

Founded in 1997 and headquartered in Waddinxveen, the Netherlands, PlayGreen is a horticultural technology company that comprises two main subsidiaries: Stadium Grow Lighting and ALVA Technology.

Altogether, the group specialises in the design, development and manufacturing of innovative lighting solutions for grass-growing in controlled environments, such as golf courses, tennis courts and football fields.

With the transaction, the GP said in a statement that its focus will be on increasing PlayGreen’s presence globally, with a particular eye on the US. In order to achieve this, the GP's focal point will be on both organic growth and acquisitions, targeting the acquisition of complementary products, technology and services.

PlayGreen’s current client base includes Tottenham Hotspur, Bayern Munich, FC Barcelona, Arsenal, the Dallas Cowboys, Milwaukee Brewers, Boston Red Sox and the Wimbledon tennis championships, among others.

The company’s offerings comprise turf management solutions including LED grow light systems, UVC light machines and turf fans.

Founded in 2015, Bruin Capital seeks opportunities in the sports sector. Since its launch, the firm has raised more than $1bn in committed capital and has closed nearly 40 acquisitions.

Its current portfolio includes sports fans-focused media firm Fair Play Sports Media, golf-focused tech specialist Full Swing and food service provider for the sport industry Proof of the Pudding.

In February, the GP invested a minority stake in Box to Box Films, a London-based production company best known for the Netflix hit Formula 1: Drive to Survive.

New York-based Bruin Capital declined to comment on the media reports when contacted by Real Deals.

This article was amended on 2 May to include the reponse to a request for comment from Bruin Capital.

Categories: Deals €200M - €500M Sectors Business Services Retail, Consumer & Leisure Geographies UK & Ireland France & Benelux

BGF has sold Hydrock, an engineering design, energy and sustainability consultancy, reaping a 6x return and a 40% IRR following a six-year hold.

The exit has been made to Stantec, an engineering services company listed on the Toronto and New York Stock Exchanges.

Headquartered in Bristol, Hydrock has a staff of 950 across 22 offices in the UK. BGF originally invested £5.6m in March 2018.

According to BGF, Hydrock has scaled its operations and expanded into new geographies and service lines under the firm’s stewardship.

During BGF’s investment period, Hydrock increased its annual revenue from £30m to £84m.

ADVISERS

BGF and Hydrock

KPMG (corporate finance)

Freeths (legal)

Stantec

DLA Piper (legal advice)

Stantec (financial due diligence)

EY (tax)

Categories: Deals Exits Sectors Energy & Environment Engineering Geographies UK & Ireland ROW

German investment firm Afinum Management has exited its stake in FAST LTA to Summa Equity for an undisclosed sum.

FAST LTA is a software company focusing on archiving, storage and recovery of data. The Munich-based company was founded in 2006 and was acquired by Afinum in 2019.

Under Afinum’s ownership, FAST LTA more than tripled Ebitda and diversified its product portfolio, customer base and international footprint.

The sale represents the fourth exit of Afinum 8.

FAST LTA generated revenue of €25m in 2023.

Summa Equity has invested in the company via its €2.3bn Article 9 Fund III.

Categories: Deals Exits Sectors TMT Geographies DACH

Midmarket GP Inflexion has sold Automotive Transformation Group (ATG) to global automotive technology company Keyloop.

The deal was valued at just under €200m and achieved a return of more than 6x, Real Deals has learned.

Headquartered in Kent, ATG provides automotive retailing solutions across digital, retention and data services, with a client base that includes retailers, manufacturers, financiers and fleet suppliers.

Its products are currently being used in 85 countries around the world and translated into 30 languages, according to its website.

Inflexion intially invested in Autofutura In 2018 through its Enterprise Fund IV. The 2016 buyout fund targeted opportunities in consumer products and services (B2C), and business products and services (B2B) sectors.

During the five-year holding period, the GP has supported a diversified strategy that included M&A, technology enhancement and international expansion.

“Transformational M&A and technological innovation drove significant earnings growth,” a spokesperson told Real Deals.

In the first year of ownership, the GP supported the business as it completed the transformational merger between Autofutura and GForces, doubling the size of the business and rebranding as ATG.

During the ownership, ATG also completed add-on acquisitions of suppliers of loyalty solutions for manufacturers, finance companies, and retailers Chrysalis and B2B car service provider Salesmaster.

“ATG also drove an international rollout strategy across Europe and the Middle East, integrating ATG’s technology stack, delivering the first global omnichannel retail solution for the automotive market,” the spokesperson added.

ATG’s current client base includes Mercedes-Benz, Jaguar Land Rover, Ford Credit, Marshall Group and Jardine Motors.

In 2023, Inflexion completed eight exits, with a total of £3.9bn returned over the previous three years, the GP said in a statement.

The 2023 exits collectively delivered a gross return of 2.9x and an average IRR of 20%, with average Ebitda growth of 82% during Inflexion’s investment period, the GP added.

In April, Inflexion-backed CNX Therapeutics acquired two CNS products from Eisai, the French sales subsidiary of international pharmaceutical company Eisai Co, for €56.5m, excluding inventory and working capital. Read more about the deal here.

ADVISERS

Inflexion

Houlihan Lokey (legal)

Taylor Wessing (legal)

DWF (legal)

Deloitte (financial due diligence and tax)

Categories: Deals Exits €200M or less Sectors Retail, Consumer & Leisure TMT Geographies UK & Ireland ROW

Family law lender Level has raised £10m, comprising a £5m equity capital investment from family office Kendal Capital and a £5m debt investment from Correlation Risk Partners.

The investment is Kendal's sixth, Real Deals has learned.

Launched in 2017 and based in the UK, Level is an FCA-regulated lender to clients and law firms in family law proceedings, probate and other related matters.

Level has also acquired probate lender Tower Street Finance, which, according to the portfolio company, exposes it to a new market that it expects to grow rapidly due to lengthy probate service processing delays and as individuals require support amid the cost-of-living crisis.

Kendal Capital’s co-founder and former CEO and founder of Bayport financial services, Grant Kurland, joins a board of advisers that includes Neil Purslow, CIO and founder of Therium Capital, and Richard Avery-Wright, CEO and founder of 1818 Venture Capital, also a major investor in the business.

The co-founder of Tower Street Finance, Jim Sission, and two key employees will join the Level team, bringing the headcount to 20.

Categories: Deals €200M or less Sectors Business Services Geographies UK & Ireland

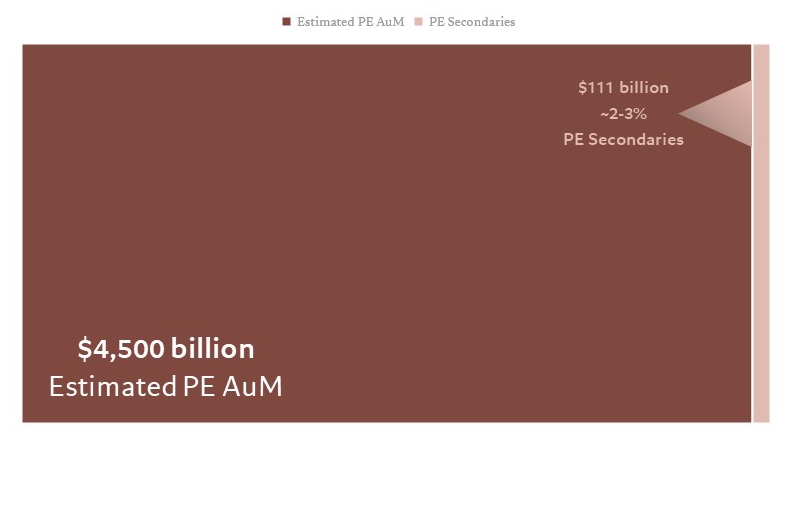

Three broad trends are worth noting in private equity’s secondary market. The first is the simplest: the sheer growth of this area of the industry. Secondary deal volumes have increased at a compounded annual growth rate of almost 15% since 2013, from a total of about $5bn in the mid-2000s to more than $100bn today. Of course, that still leaves secondaries a tiny fragment of the whole market – but it also means each additional percentage point of growth would represent a large sum in absolute terms.

Estimated secondary market size

Source: Pictet Alternative Advisors, as at 31 December 2023. For illustrative purposes only.

The second trend is worth exploring in more detail but requires some context. There are several ways in which a secondary transaction can reach the market:

• LP-led deals: when an existing investor in a fund seeks to sell their stake before the fund’s planned liquidation

• GP-led deals: when the manager of a fund seeks to move a portfolio company or companies into a continuation vehicle, rather than exit entirely

• Secondary direct: when an early investor (particularly in venture capital) seeks to realise their stake in a private company rather than wait for an IPO or the full sale of the business.

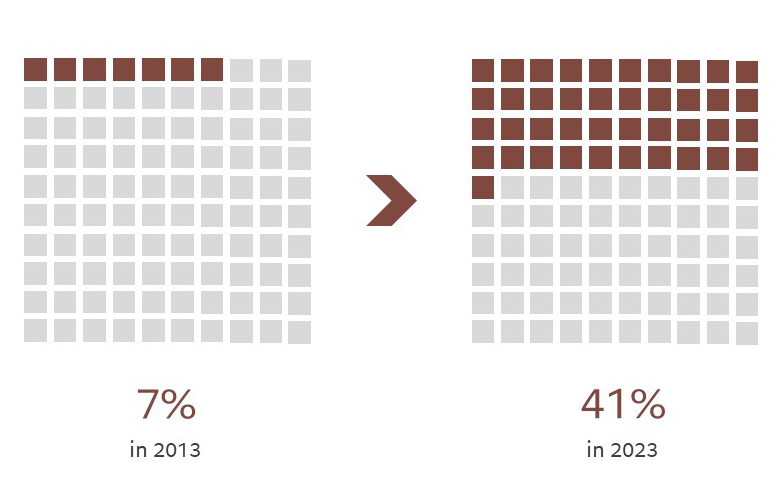

Historically, LP-led secondaries have dominated the market – but that is changing. From accounting for just 7% of all secondary volume a decade ago, GP-led transactions comprised almost half the market last year.

Share of GP-led transactions, 2013 v 2023 (%)

Source: Pictet Alternative Advisors, as at 31 December 2023. For illustrative purposes only.

Why is this the case and what does it mean for investors? As suggested by the name, GP-led secondaries are driven by the fund’s manager. They will typically identify one or several high-quality companies in their existing portfolio that they would like to retain for longer than their fund’s lifespan, because they see additional upside that could be realised with a longer hold period. So to provide the scheduled liquidity that their existing LPs expect, the GP brings in secondary investors to capitalise a new fund they will manage and buy the asset(s) for that continuation vehicle.

From accounting for just 7% of all secondary volume a decade ago, GP-led transactions comprised almost half the market last year

Put that thought process in the context of the well-known exit drought of the past few years and it becomes clearer why GP-led secondaries are becoming more common. GPs don’t want to sell into weaker markets, LPs still want distributions, so secondaries are one answer.

The inevitable question raised by this, however, is whether the GPs are holding onto their golden assets in such secondaries or simply kicking their tin cans further down the road. It is too early to speak in aggregate about the quality of the companies in the current secondary boom but we can say that LPs do have ways to create value for themselves in these deals.

The first and most important means is entry pricing, which takes us to the third trend. Secondary pricing on average in the buyout space was 99% of NAV as recently as 2017 – meaning secondary opportunities were only available at a 1% discount. The pandemic took secondary buyout pricing down to 89% of NAV in 2020 but it bounced back to 97% a year later.

The dampened market sentiment of 2022-23, though, brought much wider discounts – with average secondary buyouts at 84% of NAV in both years. This is clearly more interesting to investors but the greater margin of safety still doesn’t tell us whether gold or tin is being bought.

The growth of the secondary market is broadening and deepening the opportunity set

For that, we need to employ not only thorough due diligence on the underlying assets (where investors can benefit from greater transparency and access to information than in primary funds, because the companies are already known), but also as many other value-creation levers as possible. These include – among others – deferred payments, earn-out structures, and diversifying vintage exposure for a favourable mix of likely near-term exits and longer-term potential.

So while there are of course no guarantees with any investments, we see the combination of these trends creating compelling opportunities for disciplined and experienced investors. The growth of the secondary market is broadening and deepening the opportunity set, the rise of GP-led transactions is in many cases bringing high-quality assets to market, and the wider discounts are opening better entry points. Secondary deals will very much be a primary area of interest for the private equity industry in the years ahead.

Thibaud Roulin is head of North America private equity, Pictet Alternative Advisors

This content was produced in association with

Categories: Insights Expert Commentaries

The Riverside Company-backed Dastex Reinraumzubehör (Dastex) has completed the acquisition of Arbeidsmiljø og Energiteknikk AS (AET) from RA Service and Management.

Founded more than 30 years ago and based in Kongsberg, Norway, AET is a distributor of third-party consumables and laboratory cleaning equipment, catering to sectors including pharmaceutical, semiconductors and healthcare.

Founded in 1979 and headquartered in Muggensturm, Germany, Dastex distributes cleanroom garments and consumables in Europe.

The acquisition of AET will help Dastex with its aims to extend its geographical footprint. Establishing a direct presence in Norway will strengthen its position in the Nordics.

The GP said its focus will be on increasing commercial and marketing efforts across Norway, stimulating "commercial synergies" and capitalising on cross-selling opportunities.

Riverside acquired Dastex and its first add-on Vita Verita in March 2023. The GP said in a statement at the time that it aimed to establish a platform targeting cleanroom contamination control, with a focus on both organic growth and acquisitions.

With the transaction, AET’s current CEO Barbro Reiersøl will continue to lead the Norwegian operations under the Dastex group umbrella.

Established in 1988 and headquartered in New York, The Riverside Company eyes businesses valued at up to $400m. The firm's international private equity and structured capital portfolios include more than 140 companies.

Categories: Deals €200M or less Sectors Healthcare & Education Manufacturing Geographies Nordics DACH ROW

Investment bank Lincoln International has appointed Dr Simon von Witzleben as managing director in the firm's valuations and opinions group, based in London.

von Witzleben joins from Kroll (formerly Duff & Phelps), where he was managing director and co-head of EMEA transaction opinions.

He has more than a decade of experience advising on mergers and acquisitions, recapitalisations, carve-outs and GP-led secondary transactions.

von Witzleben will head Lincoln’s European transaction opinions business, providing fairness and solvency opinion advisory services to private equity firms, public and private companies, and boards of directors.

In 2023, Lincoln’s global valuations and opinions group completed more than 50 transaction opinions.

Categories: People Advisory moves Geographies UK & Ireland

Orthobiologics company Locate Bio has raised £9.2m following an oversubscribed funding round for a clinical study of treatment for debilitating orthopaedic conditions.

The UK-based firm secured funding from existing shareholders Mercia Ventures and BGF, as well as new investors. The funding will be used for the clinical study of its LDGraft product, a bone graft substitute for spinal fusion that was last year granted Breakthrough Device designation from the US Food and Drug Administration.

Locate Bio, a spinout from the University of Nottingham, announced in September 2021 that it had secured £10m of equity investment in a previous oversubscribed funding round.

Mercia Ventures is part of Mercia Asset Management and invests up to £10m across all sectors, specialising in software, consumer, healthcare and deeptech.

BGF, established in 2011, has invested over £3.9bn in more than 560 companies, including £200m in life sciences.

Categories: Funds Small [€200M or less] Geographies UK & Ireland

Parisian venture capital firm Ventech has achieved a 36x return on the sale of its portfolio company Believe.

A consortium composed of Believe's founder and CEO Denis Ladegaillerie, EQT, and Californian investment firm TCV, has acquired a block of 71.92% of Believe's capital – 12% of which was bought from Ventech – and will initiate a Public Tender Offer for the remaining shares at €15 per share.

The sale of the Ventech stake has been valued at €175m. The company overall has been valued at €1.52bn.

According to Ventech, the divestment represents France’s biggest venture capital exit, in multiple terms, of the past decade.

Ventech made its initial investment through its Ventech Capital III fund, which closed on €150m in 2007.

Founded in 2005, Believe is a digital music company employing 1,651 people in more than 50 countries, which aims to support independent artists and labels. Its portfolio of brands include TuneCore, Nuclear Blast, Naïve, Groove Attack and AllPoints. Believe is listed in compartment A of Euronext Paris.

Ventech is a global early-stage venture capital firm, founded in 1998. Since its inception, Ventech has raised more than €900m.

The VC is currently raising its Ventech VI fund, having had an initial closing in mid-2023. The vehicle has a target of €225m.

Categories: Deals Exits €200M or less Sectors Retail, Consumer & Leisure Geographies France & Benelux

Nordic PE firm Polaris has secured a majority stake in Swedish engineering consultancy group Vinnergi.

Vinnergi, which develops telecommunications, electrical power and construction infrastructure, has 25 local offices throughout Sweden and more than 500 employees. The firm was established in 2017 and had a turnover of SEK765m in 2023.

Polaris's investment is made in partnership with management and a group of employees.

Polaris announced in March that former CapMan Buyout managing partner Johan Pålsson had joined the firm as a partner within its.private equity team, while Camilla Ringsted, most recently an associate director at Bain, had joined as associate director.

Polaris has obtained capital commitments of more than €2bn and raised five funds since 1998. It has investments in more than 50 firms, has completed more than 100 add-ons and currently owns 16 companies with a total turnover of over €750m.

Categories: Deals Sectors Construction & Infrastructure Energy & Environment Geographies Nordics

Gideon Valkin, who has formerly worked at Monzo, Yonder and ClearScore, has launched Andrena Ventures, a $12m solo GP fund to back fintechs at pre-seed and seed stage.

The fund has reached its first close with a final close planned for later in the year. In parallel, the vehicle has also completed its first investment in Nustom, a new AI-powered software-building startup from Monzo co-founding CTO Jonas Templestein.

The inaugural fund is backed by seven VCs from the Forbes ‘Midas List’, as well as Entrée Capital; RTP Global; Taavet Hinrikus and Sten Tamkivi (co-founders of Wise and Teleport); Cherry Ventures managing partners Filip Dames, Christian Meerman, Sophia Bendz; David Haber, fintech GP at Andreessen Horowitz; and Firat Ileri, managing partner at Hummingbird Ventures.

Valkin has spent 15 years in the VC ecosystem as a founder, operator and investor.

Categories: Funds Small [€200M or less] Venture Sectors TMT Geographies UK & Ireland

Goldman Sachs Alternatives is to buy UK environmental risk reduction and advisory firm Adler & Allan from an affiliate of Sun European Partners.

The Sun European affiliate acquired Harrogate, UK-based Adler & Allan in November 2020, which has subsequently more than doubled in size. It has completed nine add-ons, strengthened its management team and shifted away from hydrocarbons into renewable energy.

Adler & Allan plans to expand via both organic growth and M&A activity. The firm’s leadership team will remain in place, led by current group CEO Henrik Pedersen.

Sun European affiliates have invested in more than 540 companies globally, with a turnover of approximately €4bn. Private Equity at Goldman Sachs Alternatives has invested more than $75bn since its inception in 1986.

ADVISERS

Sun European

Houlihan Lokey (corporate finance)

OC&C (commercial due diligence)

KPMG (financial due diligence and tax)

Weil, Gotshal & Manges LLP (legal)

Goldman Sachs

Linklaters (legal)

EY Parthenon (commercial due diligence)

KPMG (financial due diligence and tax)

Categories: Deals Sectors Business Services Construction & Infrastructure Energy & Environment Geographies UK & Ireland

UK and Ireland PE firm BGF has completed a multimillion-pound investment in sports marketing business Eleven Sports Media.

Founded in 2009 with offices in the UK's Northwest, Eleven constructs local partner programmes for rights holders at global sporting venues, including Yankee Stadium and London Stadium.

It provides local businesses with a growth platform through fan, club and community engagement.

BGF said in a statement that it will support the business’s international growth and increase Eleven’s foothold in the US market, which already accounts for more than half of overall sales according to a statement by the GP.

In terms of value creation, Eleven plans to keep on growing the team in its Manchester office and make strategic hires in the US, as part of plans for opening a new office in Charlotte, US in 2025.

Eleven entered the US through its partnership with New York City Football Club in 2021, and the business has since added American Football teams Carolina Panthers, New Orleans Saints and New York Jets.

Current partnerships also include the Premier League, NFL, EFL and NBA, among others.

Partner at BGF Josh Bean has joined the Eleven board as non-executive director.

Established in 2011, minority, non-controlling partner BGF explores opportunities in the UK and Ireland, and has invested £4bn in more than 560 companies,

Last week, BGF invested £3.25m in Boxphish, a Leeds-based human risk management platform. Read more about the deal here.

ADVISERS

BGF

DLA Piper (Legal)

Hurst (Tax DD)

Squire Patton Boggs (legal)

RSM (tax structuring)

Categories: Deals €200M - €500M Sectors Business Services Retail, Consumer & Leisure Geographies UK & Ireland ROW

Automation is top of Nexxus Iberia’s shopping list following its purchase of Spanish supermarket equipment manufacturer Creaciones Marsanz, the investor’s lead partner Juan Pedro Dávila tells Real Deals. Though in the process of implementing an enterprise resource planning (ERP) system, there is still a lot to be done for its newest portco, he adds.

Founded in 1965 and based in Madrid, Creaciones Marsanz is a family-owned retail equipment manufacturer, including shopping carts, handling and logistics equipment, commercial shelving, entrance and exit devices, and checkout counters for national and international retailers.

Spanish GP Nexxus Iberia acquired a majority stake in Creaciones Marsanz last week, marking the first investment from its Nexxus Iberia Private Equity Fund II, which held a final close on €241m earlier this year.

“Today, Creaciones Marsanz’s three small factories – and overall company – lack automation. Processes are manual and basic,” says Dávila. “Going from mainly manual to automated processes requires a detailed plan and time, as well as having both operations and the financial department linked together. It is a project that will take over a year, but we’re comfortable with that.”

It is a project that will take over a year, but we’re comfortable with that

Juan Pedro Dávila, Nexxus Iberia

Noting the substantial value to be generated in exchange for the work, the partner added that the grocery market industry is one of the most resilient during a potential crisis.

In Spain, the sector remained flat during the global financial crisis, and has grown every year since 2013, according to the investor.

Deal origination

Established in 2016, Nexxus Iberia is an affiliate of Mexican alternative asset manager Nexxus Capital. Having already invested its first fund, the PE firm typically invests in Spanish and Portuguese small- to midsized companies, a criteria that applies to Creaciones Marsanz.

The deal was brought to Nexxus by advisory firm Alanza DTE, which the buyer has been working with for "many" years. From there, a conversation took place between the GP and the portco, with no other PE firms involved in the process.

Though Nexxus applied its usual due diligence process, it still took seven months from the GP becoming aware of the deal to completing it.

“Typical family-owned businesses with little available analytical information make the investment process more cumbersome,” Dávila says.

That said, Nexxus, committed to closing the deal, was able to gain the retiring shareholders' trust.

Value creation

The portfolio company had 179 employees and a turnover of €33m last year. Nexxus Iberia's ambition is to double the size of the company.

Further to automating processes, reaching its value creation goals will also involve launching new products, reinforcing the management team and internationalising the company.

Marsanz’s main clients are Spanish retailers, but the portco already sells about a third abroad – including to Portugal, France and the UK, as well as some Latin American countries – with the intention to increase its presence in Europe and LatAm.

We usually do a digitalisation plan that takes between one and two and a half years to implement, to make sure that we can leverage all the technology that makes sense for the company

Juan Pedro Dávila, Nexxus Iberia

While focused on supermarkets, the business also provides trolleys for other industries, such as logistics companies, airports and hotels.

Today, approximately 20% of the company’s sales have been from these additional lines of businesses, and the GP intends to boost those as part of its plans.

On the broader digitalisation project, Dávila says: “We usually do a digitalisation plan that takes between one and two and a half years to implement, to make sure that we can leverage all the technology that makes sense for the company and that it is able to absorb.”

Creaciones Marsanz joins Nexxus Iberia's current portfolio of companies, which includes Mirplay, OFG, Solutex and La Margarita.

ADVISERS

Nexxus Iberia

Pinsent Masons (legal)

EY (commercial, financial and ESG due diligence, and tax)

Aon (insurance due diligence)

Creaciones Marsanz

Alanza DTE (corporate finance)

Garrido (legal)

Categories: Deals Deals in Focus Sectors Retail, Consumer & Leisure Geographies Southern Europe

With impact funds’ $200bn of dry powder competing for a relatively small number of assets, eye-watering valuations have taken ‘pure play’ impact businesses beyond the reach of most private equity houses.

However, there’s a growing opportunity for priced-out investors to think smart and find alternative routes to generating value within their portfolio.

It requires impact to be viewed not as a binary investment strategy, but a chance to identify and amplify impact-led growth within portfolio businesses’ existing products and services.

Leveraging existing impact

To be considered an impact business, most funds require a high percentage of products and services to be delivering positive social or environmental outcomes. This has seen capital naturally flow towards assets where the effect is clear and obvious, such as renewable energy, agritech or healthcare.

But this is quite a narrow and limiting view of impact.

There are plenty of non-impact companies with products or services that deliver significant environmental and social gains. Often this impact remains ‘under the radar’ as these benefits are not captured, measured and considered as part of a wider investment strategy by either management teams or their backers.

Viewed through a data-led lens, these businesses have an opportunity to fully understand their impact and leverage to drive growth, provide resilience and enhance valuations.

It makes qualifying and quantifying impact an interesting and attractive consideration for private equity.

Impact is everywhere

Management teams and investors appreciate how important ESG performance is to raising finance and delivering long-term sustainable value. But it’s clear that many companies which don’t align themselves closely to concepts like purpose and impact are generating significant positive outcomes for society and the environment.

One ‘traditional’ telecoms provider we worked with, for example, was delivering services that were:

• Increasing connectivity to rural communities

• Stimulating job creation and business growth

• Supporting access to critical services including health

• Facilitating the development of smart cities

• Enabling the expansion of electric vehicle networks.

When these benefits were quantified using robust ESG metrics, it was clear the company was making a significant tangible difference to economic growth, societal improvement and low-carbon transition.

Another good example is a fire and security specialist. Ongoing development of its market-leading product portfolio resulted in the business increasing the lifespan of its solutions and replacing physical maintenance requirements with remote digital interventions.

As management’s principal focus was on technology innovation and manufacturing efficiency, how its product and process innovations were helping significantly reduce emissions wasn’t a primary consideration, and therefore wasn’t being measured.

Now this tangible impact is being qualified, reported on and embedded as a key differentiator in a highly competitive market.

A transformative understanding

With these examples, and many other private equity-backed businesses, identifying and capturing impact has been transformative. Through analysis and measurement, they have been able to successfully define their impact and incorporate metrics and strategies into their growth and exit plans.

Crucially, they haven’t had to suddenly pivot to become ‘purpose-led’.

Instead, it has provided fresh impetus, strategic direction and focus. They are now pursuing new opportunities that deliver even more impact… thereby unlocking additional value creation and investment opportunities. It’s helping inspire, guide and motivate management teams, and is acting as a key differentiator with customers and talent.

It has also been the trigger to embed good ESG practices that will ultimately support continuous improvement, ongoing innovation, resilience and exit valuations.

If you can’t measure it…

Unlocking the opportunities presented by impact requires a strategic approach to ESG that aligns businesses to the requirements of all stakeholders… from customers through to lenders.

There isn’t a standardised method by which the midmarket analyses how products and services are delivering impact. Therefore, management teams and their backers need to look at how best practice ESG reporting frameworks can evolve to include impact.

These frameworks will help maintain focus on key operational factors, create consistent reporting models and inform delivery plans within operational enhancement and investment strategies.

A key value driver

Taking a less binary view of impact enables private equity to identify new opportunities within their portfolio and pipeline. It supports fundraising, LP communications and underpins the credibility of private equity investors’ ESG messaging.

Ultimately, impact is relevant to everyone and all companies can deliver it. Unlocking this potential requires us to better identify and quantify impact and incorporate it into strategic business growth.

Impact is highly prized by the market, so evidencing and increasing it will help lower the cost of debt, broaden buyer pools, drive competition and ultimately increase valuations at exit.

Jo Daley is director, head of impact at Clearwater International

This content was produced in association with

Categories: Insights Expert Commentaries

Swiss investor Ufenau Capital Partners has acquired German engineering firm IPP Group through its Ufenau Fund VII, which held its first and final close on €1bn in April 2022.

Headquartered in Kiel, Germany, IPP provides engineering services for infrastructure and energy projects.

With more than 150 employees spread over eight sites, the business delivers planning and surveillance for critical infrastructure projects, such as road renovations, water and wastewater systems, and hydrogen plants.

With Ufenau's investment, IPP intends to consolidate the infrastructure-focused engineering services market via bolt-on acquisitions. Simultaneously, IPP will continue to invest in the expansion of its services, employee recruitment and digitalisation.

Headquartered at Lake Zurich, Ufenau focuses on investments in service companies in German-speaking Europe, Iberia, Poland, the Benelux region and the UK.

Since 2011, Ufenau has invested in more than 350 service companies in Europe and currently advises capital of €3bn.

Categories: Deals Sectors Construction & Infrastructure Energy & Environment Geographies DACH

Ardian, through its expansion team, has entered into exclusive negotiations for a “record-breaking” fundraising round to support human resources sevice provider HR Path.

Founded in Paris in 2001, HR Path offers services ranging from HR strategy consulting (Advise) to HR services (Implement) and payroll outsourcing (Run).

With a workforce of 1,800, the business currently generates annual sales of €215m.

Ardian currently manages or advises $164bn of assets, spanning private equity, real assets and credit.

The GP, alongside Société Générale Capital Partenaires (SGCP), first invested in HR Path in the summer of 2015.

Ardian, Activa Capital and SGCP further invested €30m in April 2017.

The funds raised will be used to accelerate the company’s international expansion and extend its value proposition.

Ardian’s deal team comprised Arthur De Salins, Marie Arnaud-Battandier, Steven Barrois, Pierre Peslerbe and Sibylle Bourgeois.

ADVISERS

Ardian

Latham & Watkins (legal)

KPMG Avocats (legal)

Indéfi (commercial due diligence)

Eight Advisory (financial due diligence)

Categories: Deals Sectors Business Services Geographies France & Benelux

TDR Capital and I Squared Capital have successfully bid for listed Spanish certification firm Applus Services.

The pair's winning offer of €12.78 per share was confirmed by the Spanish markets regulator, CNMV, following an auction process.

The successful bidding entity, Amber Equity Company, will now enter an acceptance period for Applus Services.

“We are delighted to have won out in what was a long and intensive process,” said I Squared senior partner Mohammed el Gazzar. “We are looking forward to working with the leadership team in the coming weeks and months to ensure a smooth transition to private ownership.”

Applus – which provides testing, inspection and certification services to the automotive, energy and industry, and laboratories markets – reported revenue of €2.06bn in 2023 and employs more than 26,000 people in over 70 countries.

According to the investor, Applus recently moved its focus to higher-growth opportunities in labs, renewables, power and infra segments. It added that the deal positions Applus for changing industry dynamics, which includes regulatory scrutiny, the shift to more sustainable transport and electrification.

With more than $38bn in assets under management, I Squared is a global infrastructure investor headquartered in Miami.

TDR, which has more than €15bn in assets under management, said it typically holds controlling interests in European companies beyond the industry average.

TDR managing partner Gary Lindsay said: “This is an excellent outcome for the public market investors who backed Applus. We now believe that the business should be better for all stakeholders, without the constraints and short-term focus imposed by the public market.”

This deal follows the take-private of Aggreko PLC in August 2021, which was jointly completed by the two firms.

Categories: Deals €500M or more Sectors Business Services Construction & Infrastructure Geographies Southern Europe

London-based Agathos Management has invested in UK survey firm Plowman Craven.

It is the fourth investment from the PE firm’s Fund II, which launched in 2021, and Agathos’s 12th investment overall.

Based in Harpenden, UK, Plowman Craven provides measurement survey and consultancy services to the commercial property, logistics, infrastructure and rail sectors.

It has 180 employees across its HQ and offices in Central London, Birmingham, Ahmedabad and New York.

Established in 2014, Agathos invests in UK founder-owned and managed businesses valued at up to £25m.

The GP said Plowman Craven is well positioned to benefit from long-term market drivers in the sector, including continued adoption of 3D modelling methods, automation in the logistics sector and ESG regulation in the broader property sector.

Agathos’s capital injection will be used to accelerate Plowman Craven's international growth, develop its geotech capabilities and client digital services, and target bolt-on acquisitions.

The transaction also facilitates Plowman Craven's long-planned succession goals, with managing director Andy Molloy retiring after spending 15 years steering the company. He oversaw a management buyout in 2012.

David Locker, who has been operations director since joining the business in 2016, will succeed Molloy as CEO.

Adrian Ringrose, former CEO of Interserve and serial non-executive director, will join the board as non-executive chair.

Hugh Costello, John Butterworth and Chanelle Jones led the transaction from Agathos. Costello and Butterworth have also joined the Plowman Craven board.

ADVISERS

Agathos

Stephenson Harwood (legal)

FRP (debt advisory)

Grant Thornton (financial due diligence and tax)

CIL (commercial due diligence)

Continuum (organisational due diligence)

Plowman Craven

Sherrards (legal)

CMS (tax)

Categories: Deals €200M or less Sectors Business Services Construction & Infrastructure Geographies UK & Ireland

Infrastructure and private debt are the most attractive asset classes, with 71% of institutional investors expecting to increase allocation to each during the next one to two years, according to a recent survey by State Street Corporation.

State Street examined the allocations of 480 institutional investors across North America, Latin America, Europe and Asia-Pacific for its third annual private markets survey.

However, in the longer term, private equity is set to return to favour, with 73% of surveyed investors planning to increase allocations to the asset during the next three to five years, the survey noted.

Some 33% of respondents also expect to decrease their exposure to private equity, compared to 54% in real estate and 29% in infrastructure and private debt.

Despite investors seeing macro challenges abating, their impact is expected to continue in the near term. To overcome this, institutional investors expect private market sponsors to adjust their strategies – exploring fresh market niches, tapping new sources of funding and hiring staff in specialist areas.